Featuring Charts

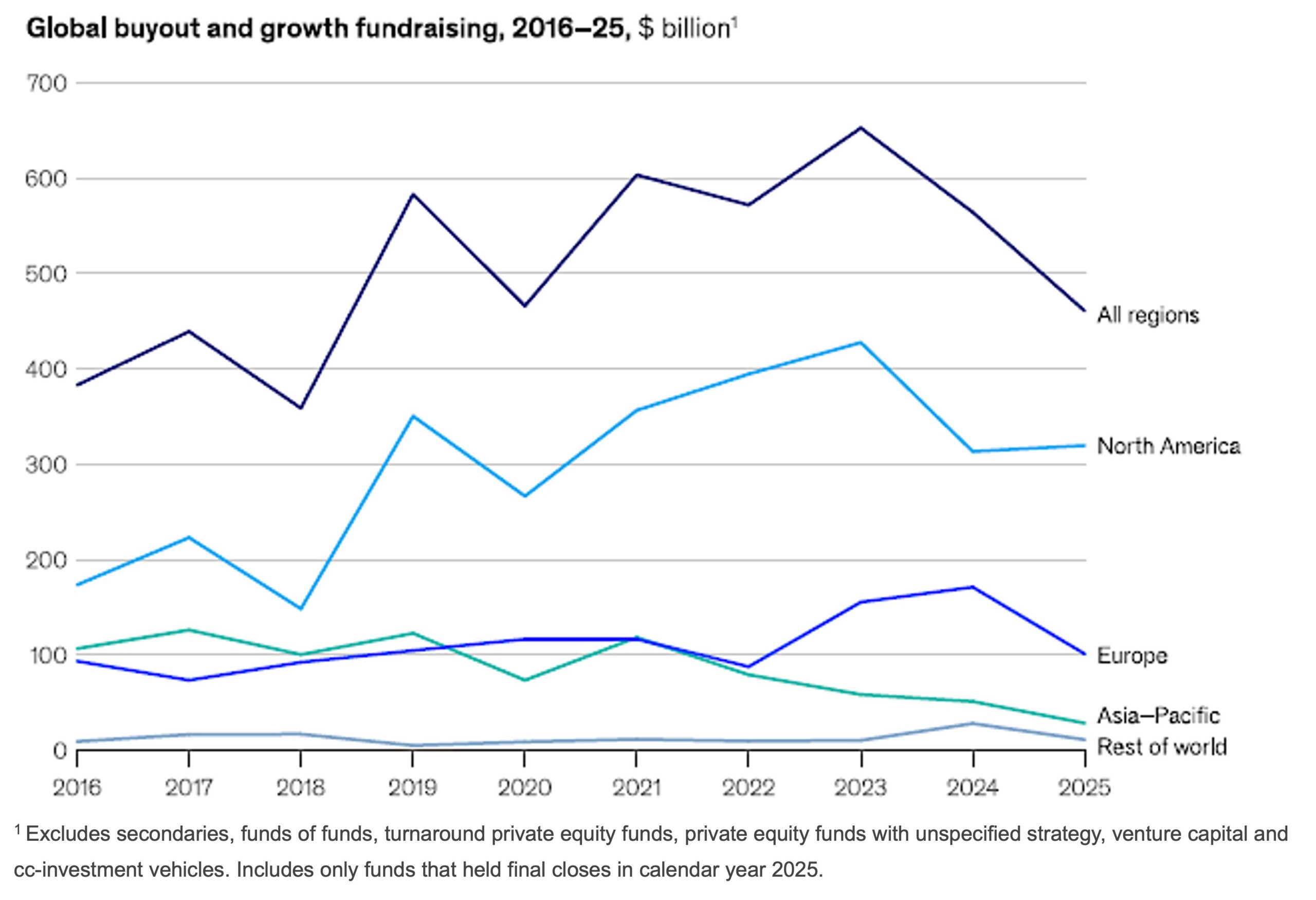

Chart of the Week: Leading the Way

The US was a relative bright spot in global private equity fundraising in 2025. Source: Preqin, McKinsey analysis

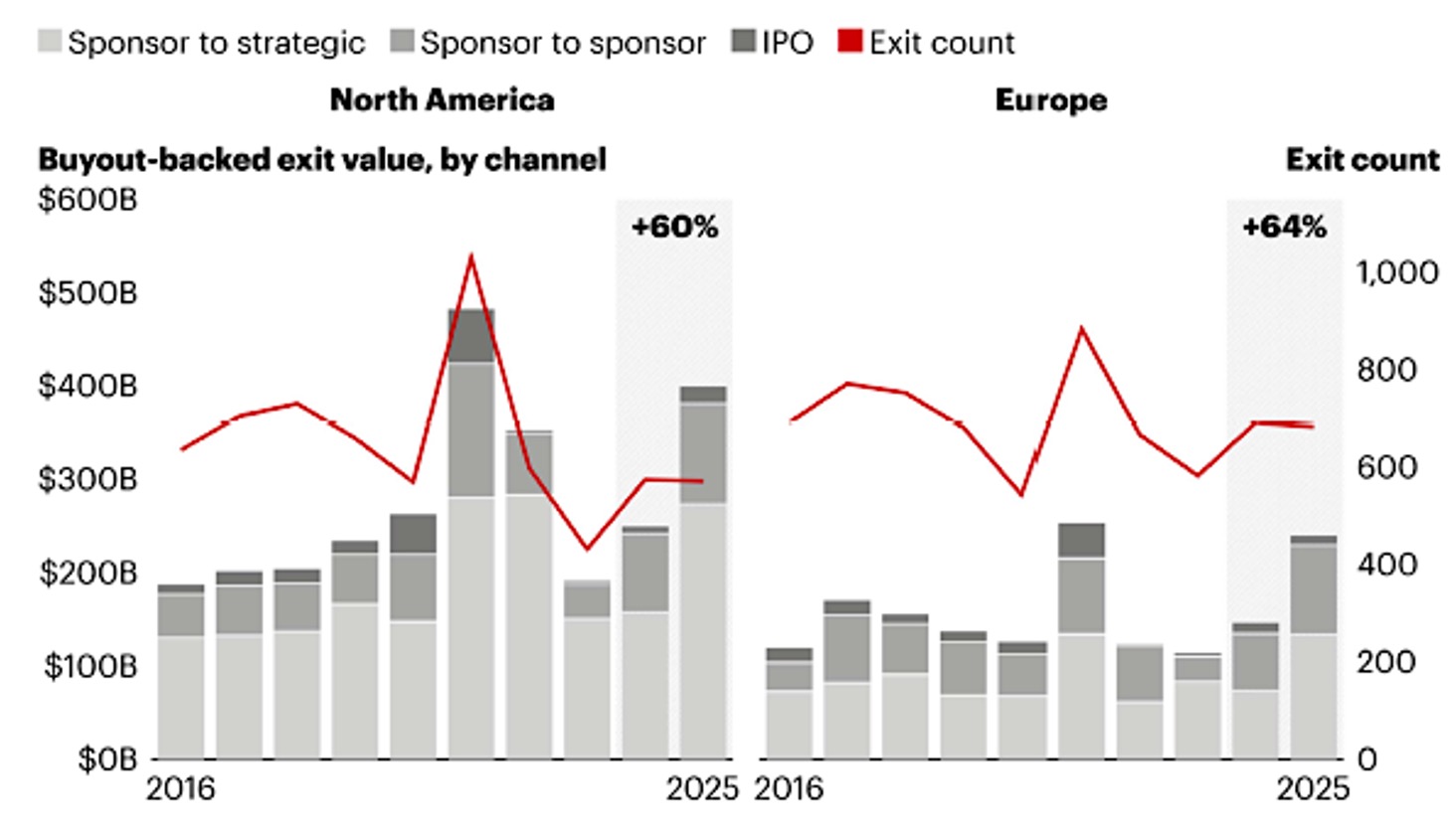

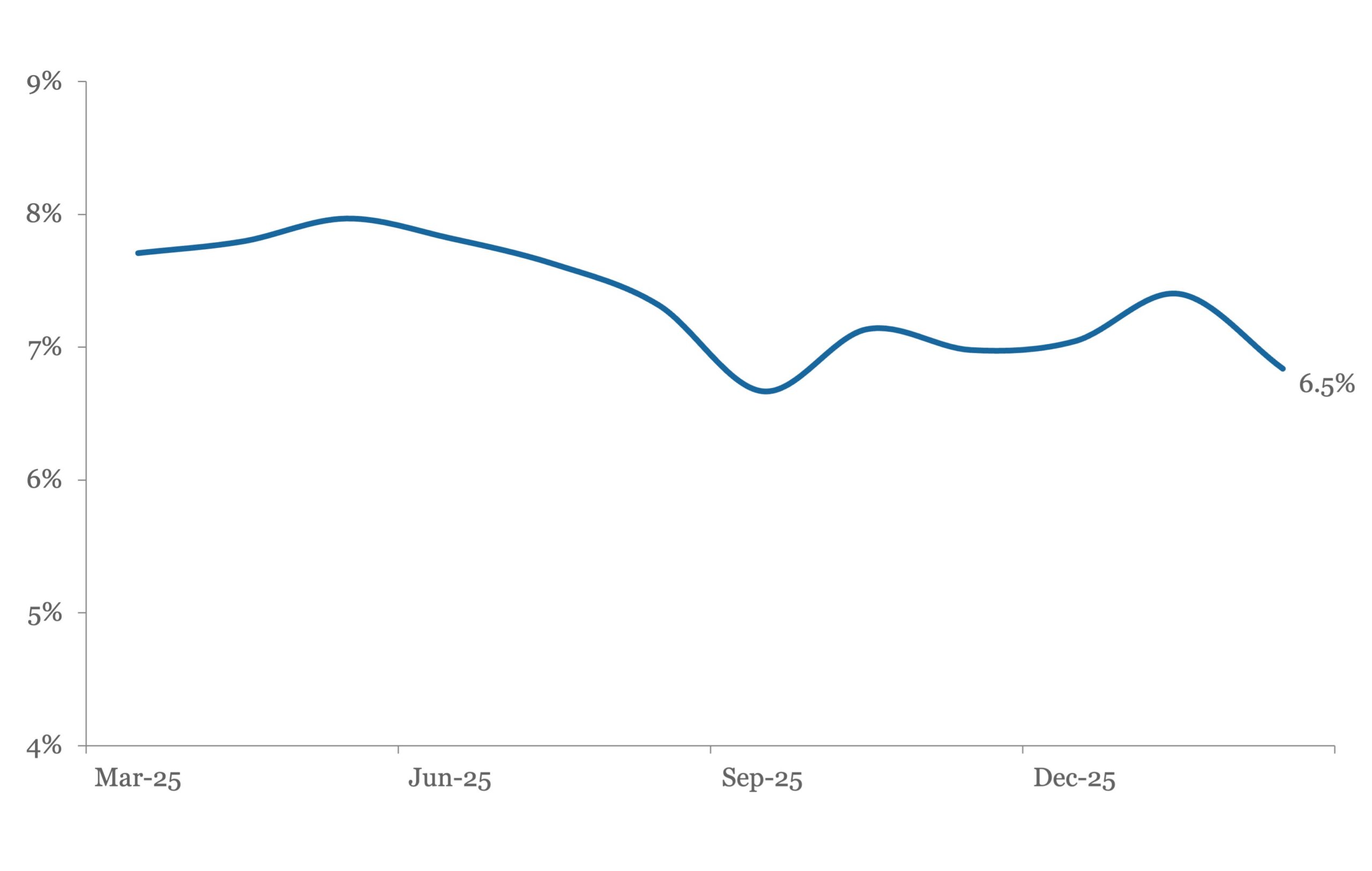

Read MoreChart of the Week: Clearing the Backlog

US and European exits were on the rise in 2025. Source: Dealogic, Bain & Company

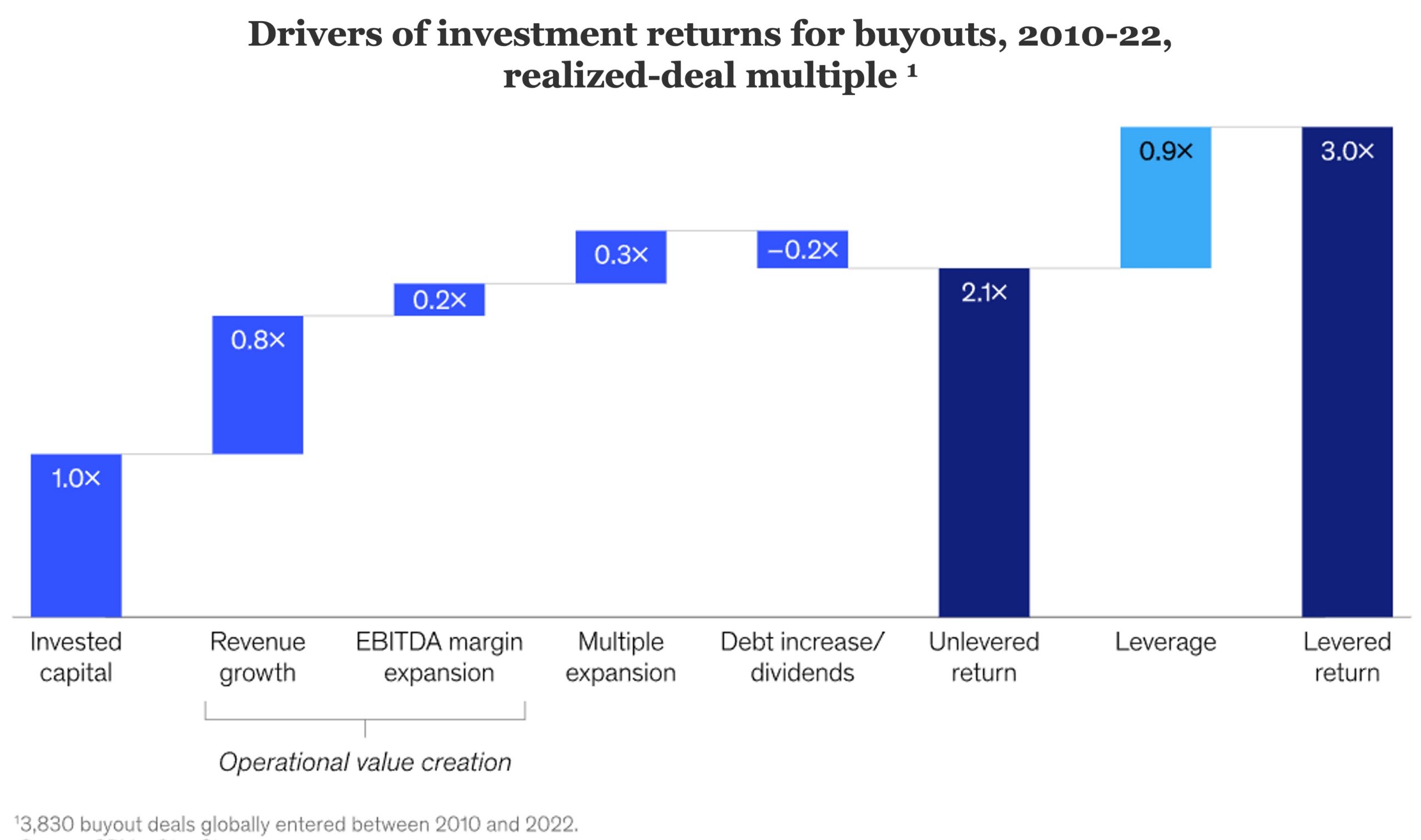

Read MoreChart of the Week: Growth is King

Private equity returns are largely attributable to revenue growth. Source: McKinsey & Co, SPI by StepStone

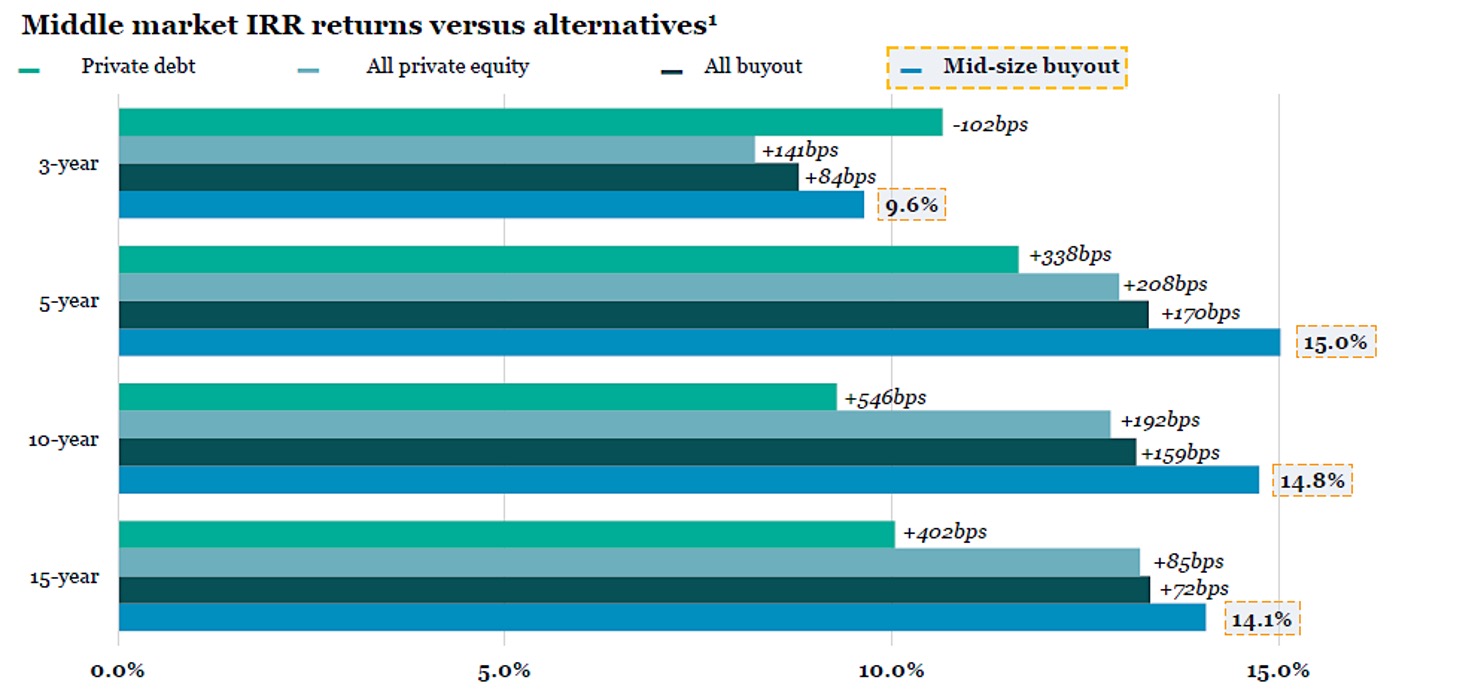

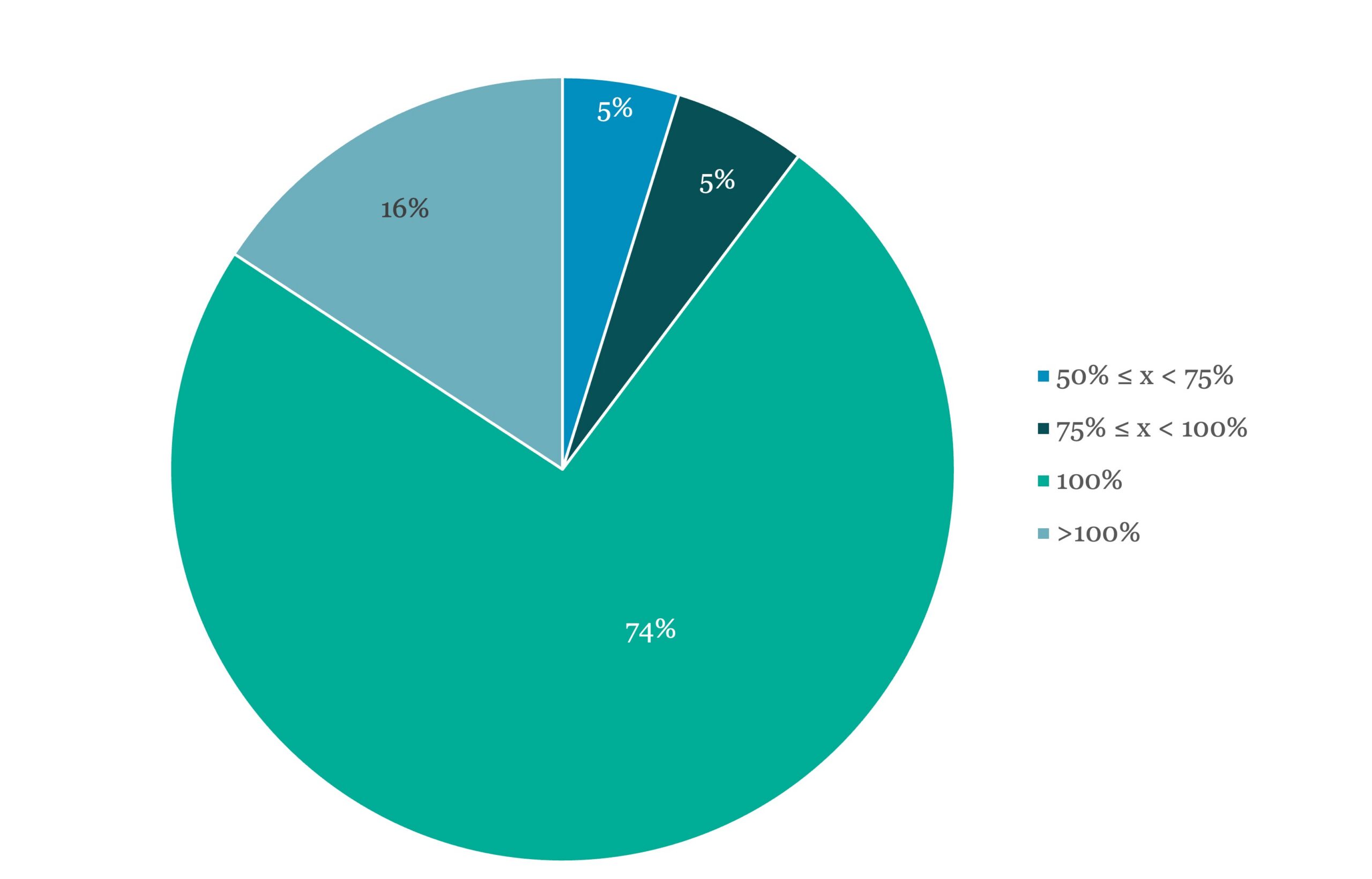

Read MoreChart of the Week: The Sweet Spot

The middle market punches above its weight. Source: State Street Private Equity Index as of 9/30/2025

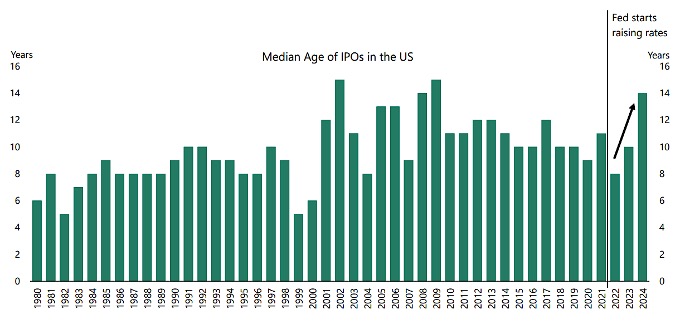

Read MoreChart of the Week: Private-Side Only

US companies that go public are opting to stay private longer. Source: Jay Ritter, University of Florida; Apollo’s The Daily Spark

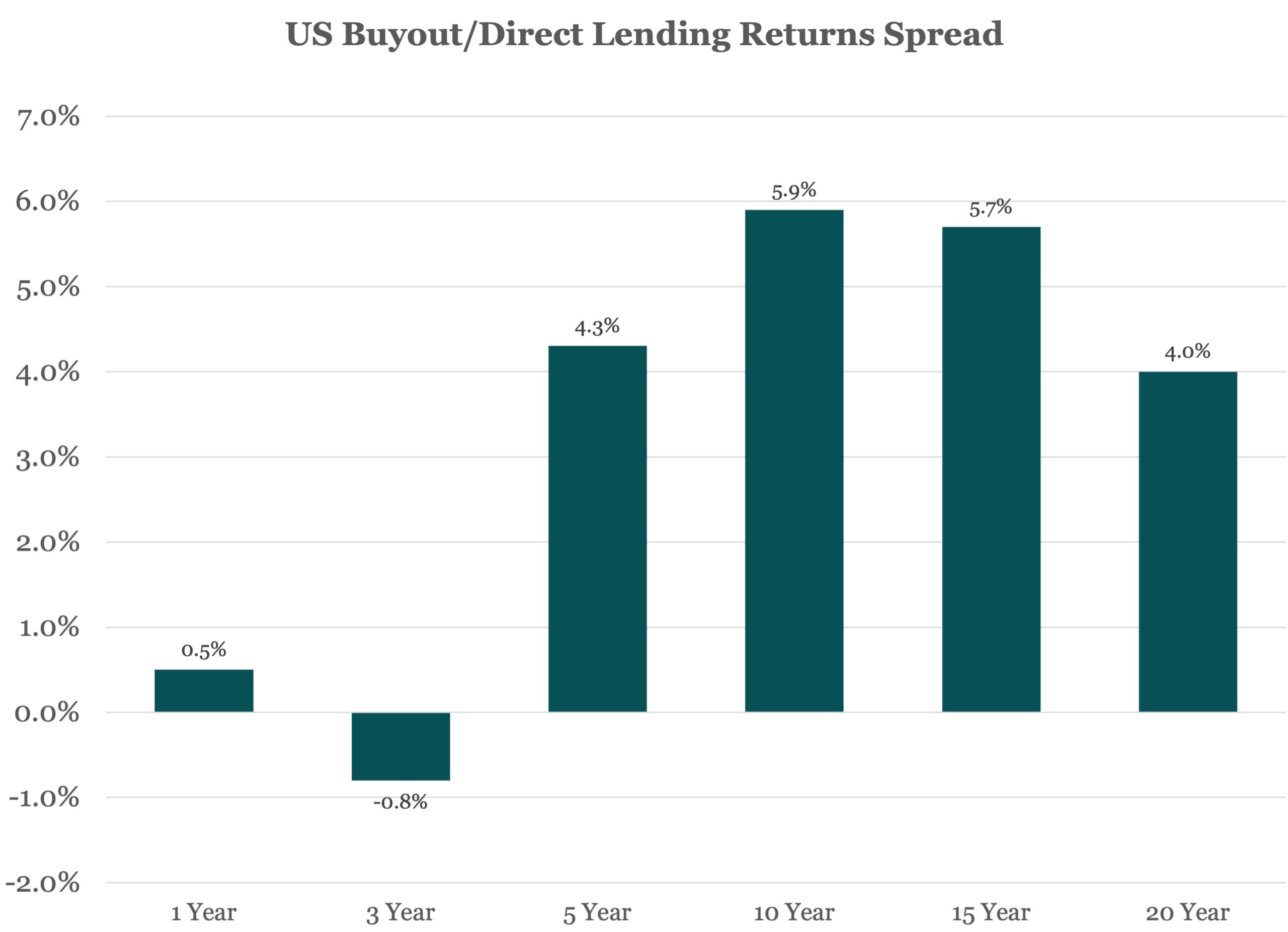

Read MoreChart of the Week: The Equity Premium

In the long-term private equity pays for more risk with better returns. Source: MSCI

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

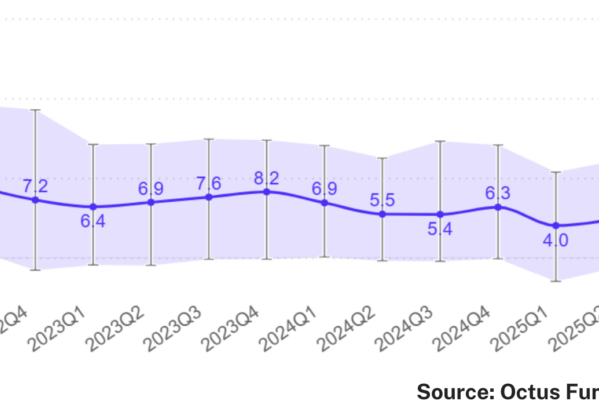

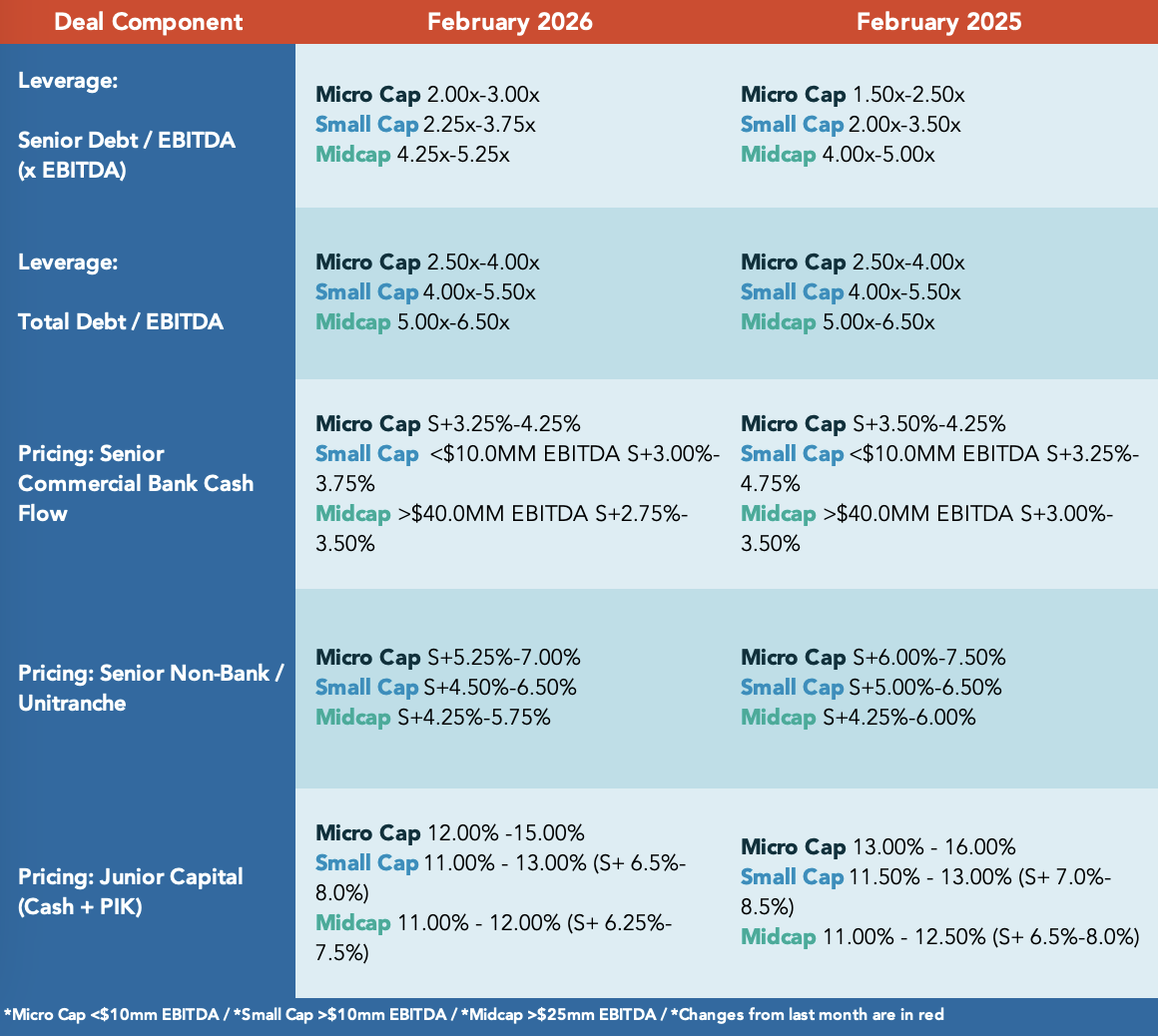

Octus: Private Credit & Deal Origination Insights – 3/9/2026

U.S. Sub-Investment Grade SaaS Companies – QRT Revenue Growth YoY Click here to watch Octus Webniar: Investor’s Guide to Navigating AI Fallout on the Credit Markets… Subscribe to Read MoreAlready a member? Log in here...

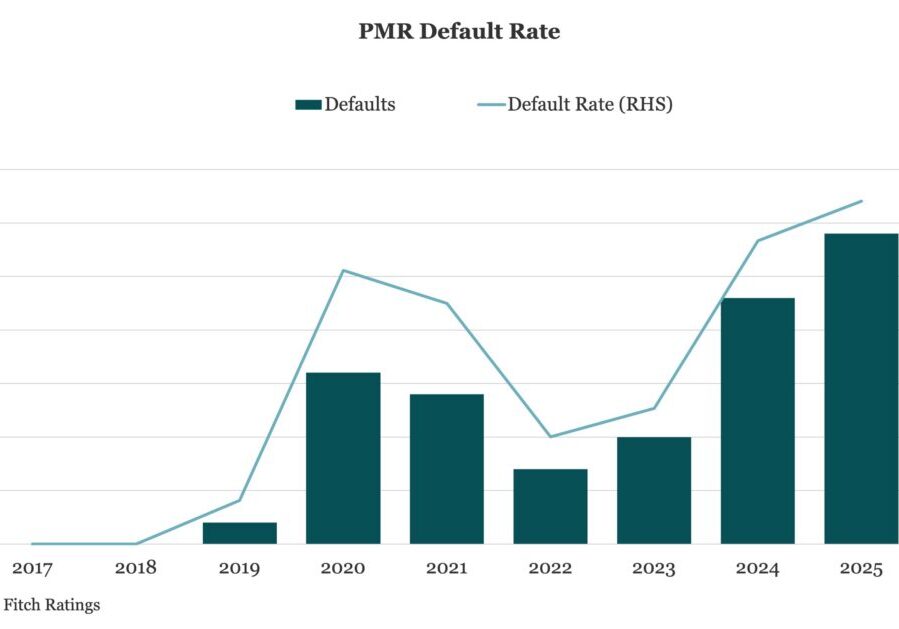

Middle Market & Private Credit – 3/9/2026

US Private Credit Defaults Hit New Highs but Losses Remain Contained Click here to learn more. The default rate in Fitch Ratings’ privately monitored ratings (PMR) portfolio hit 9.2% in 2025, a new high, up significantly from 8.1% in 2024. Defaults were not concentrated in any particular sector, though Fitch recorded four defaults in the…

The Pulse of Private Equity – 3/9/2026

Multiples on BSL-funded LBOs Download PitchBook’s Report here. Debt capacity limitations have meant sponsors are pressured to deploy more equity capital to fund their portfolio investments…. Subscribe to Read MoreAlready a member? Log in here...

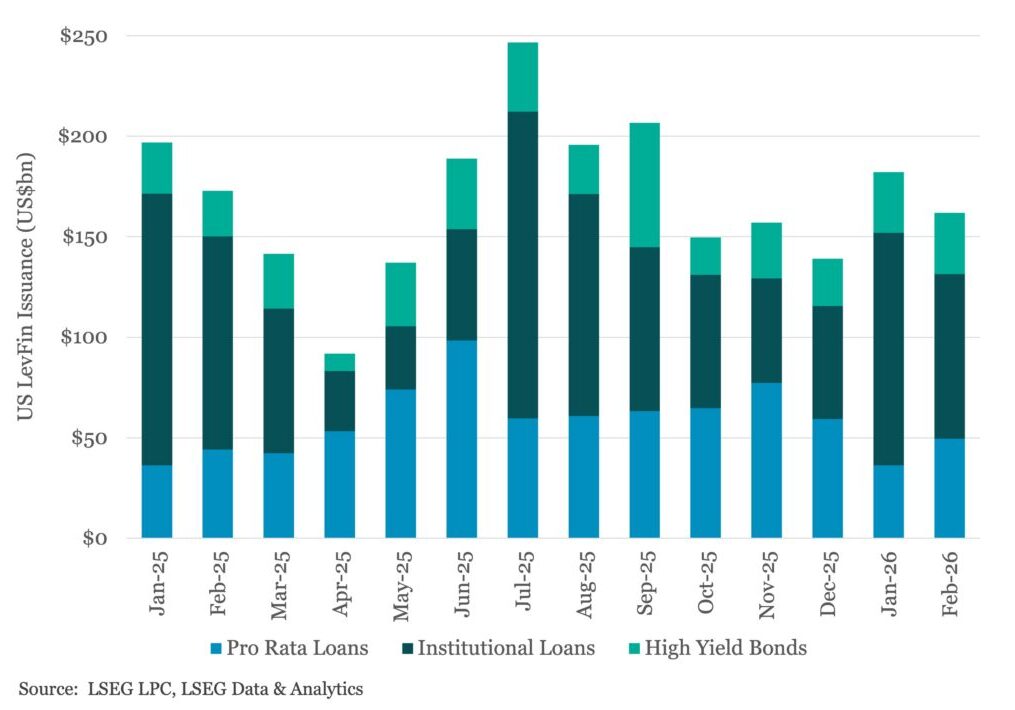

Leveraged Loan Insight & Analysis – 3/9/2026

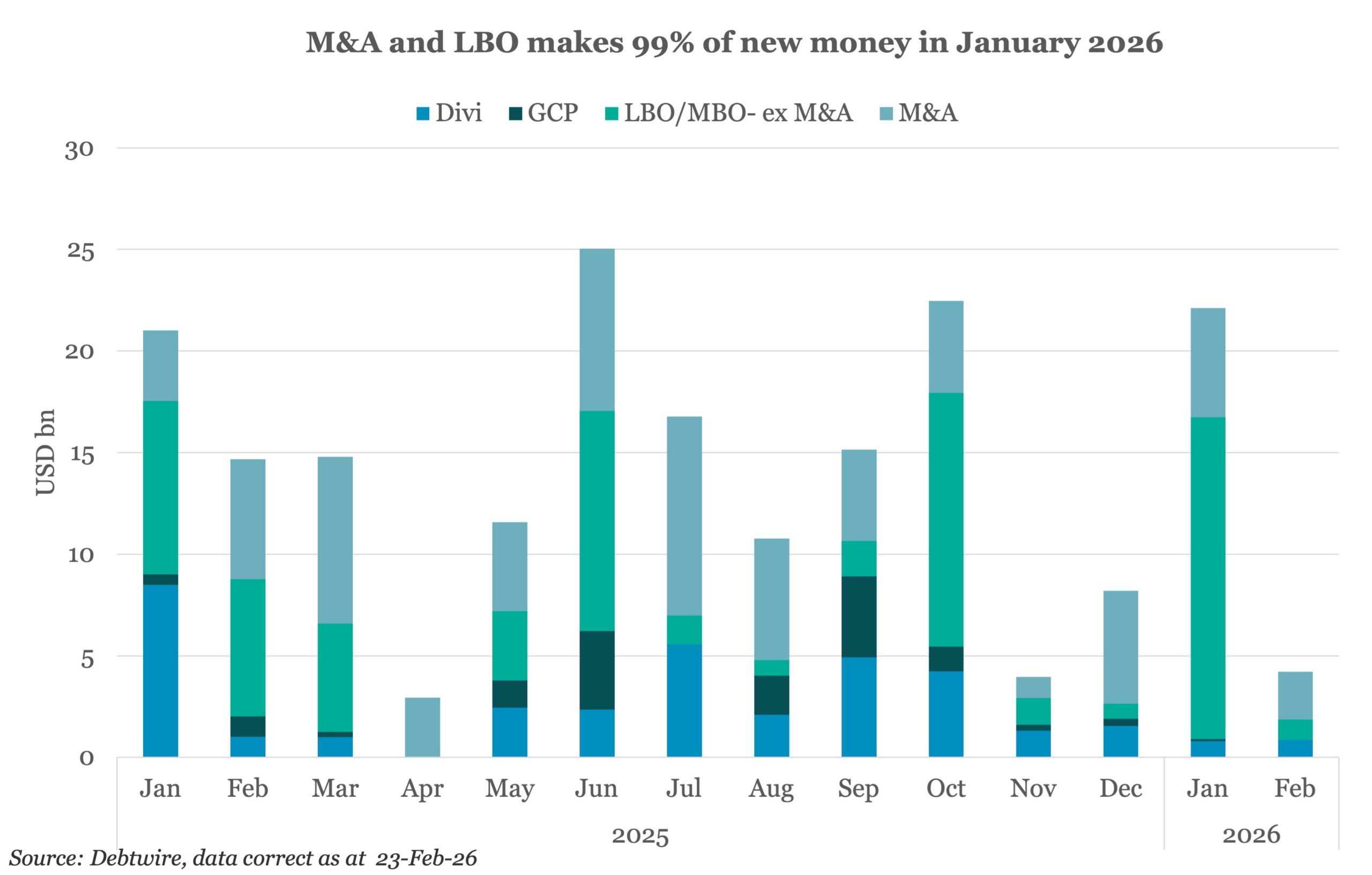

US LevFin issuance slips in February amid softer, more volatile market backdrop US LevFin issuance topped US$160bn in February, although business slipped 11% from January amid a noticeably weaker market backdrop. Bank loans came back following a somewhat slower month (US$50bn) and high-yield bonds matched January’s issuance (US$30bn), while institutional loans, which drive the majority…

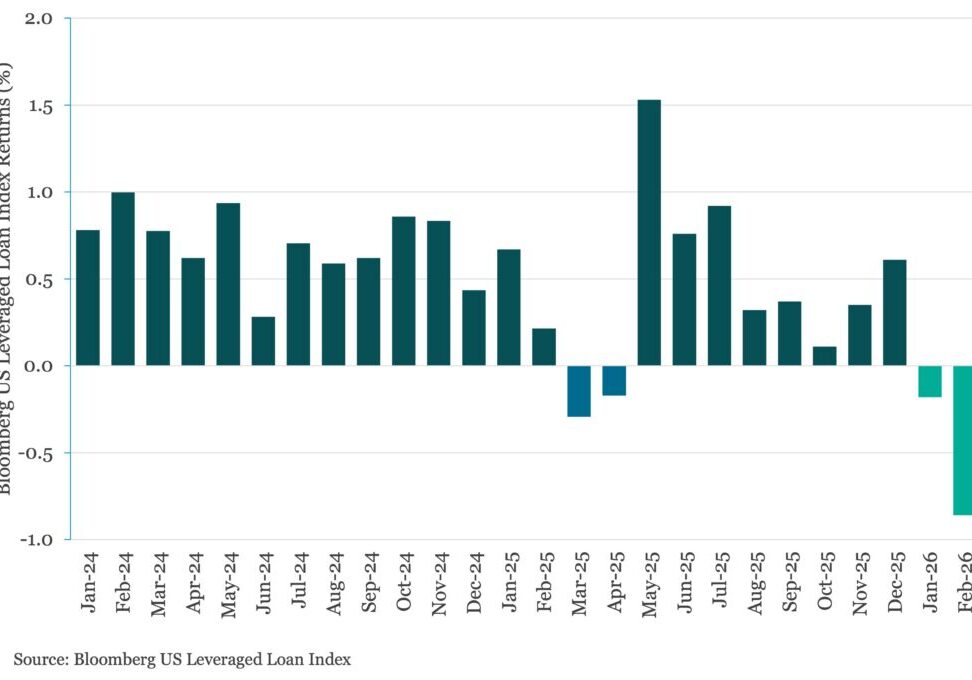

Bloomberg: Leveraged Lending Insights – 3/9/2026

US Leveraged Loans Extend Declines in February Click here to access Bloomberg’s latest Global Leveraged Loan Index Report The Bloomberg US Leveraged Loan Index (Ticker: LOAN) posted a negative return of -0.86% in February, marking the first consecutive monthly decline since last April. Average secondary market prices on US leveraged loans dropped to 94.89 on…

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.