Featuring Charts

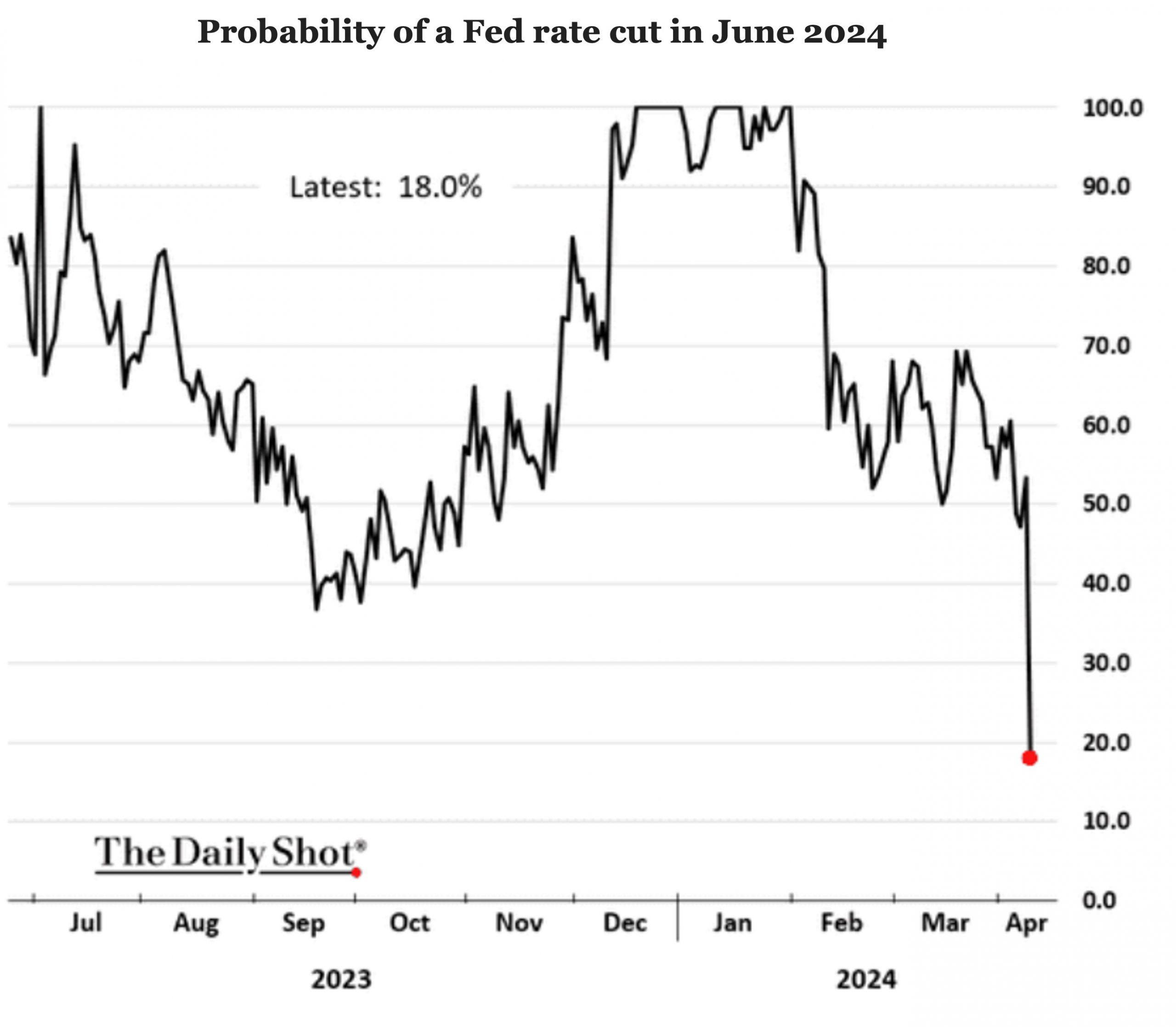

Chart of the Week: No Ifs, Ands, or Cuts

Market observers now think a rate cut at the Fed’s June meeting is unlikely. Source: The Daily Shot(Past performance is no guarantee of future results.)

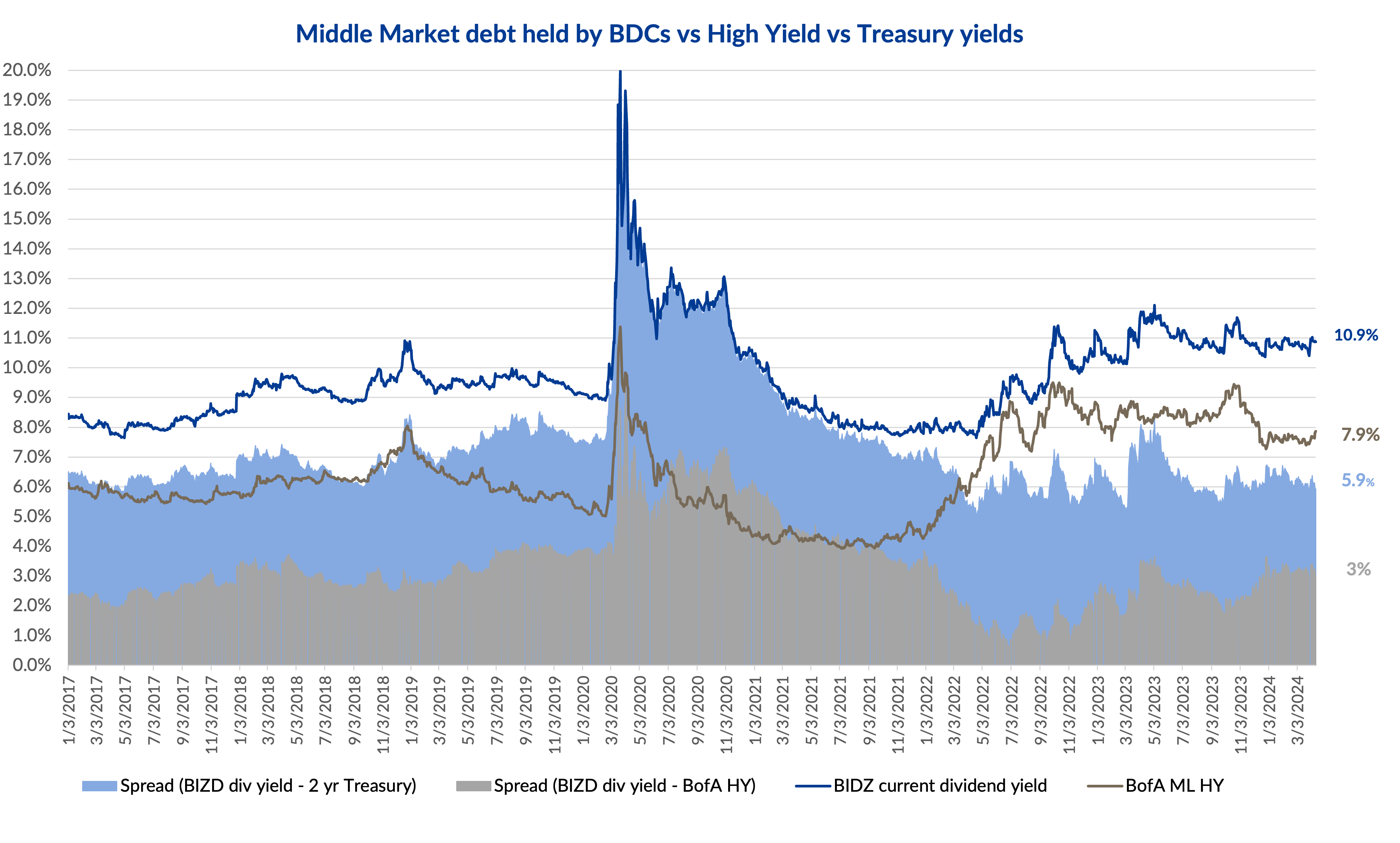

Read MoreChart of the Week: Honey, I Shrunk the Interest Coverage Cushions

The Fed’s “higher-for-longer” has compressed leverage loan coverage ratios. Source: PitchBook | LCD(Past performance is no guarantee of future results.)

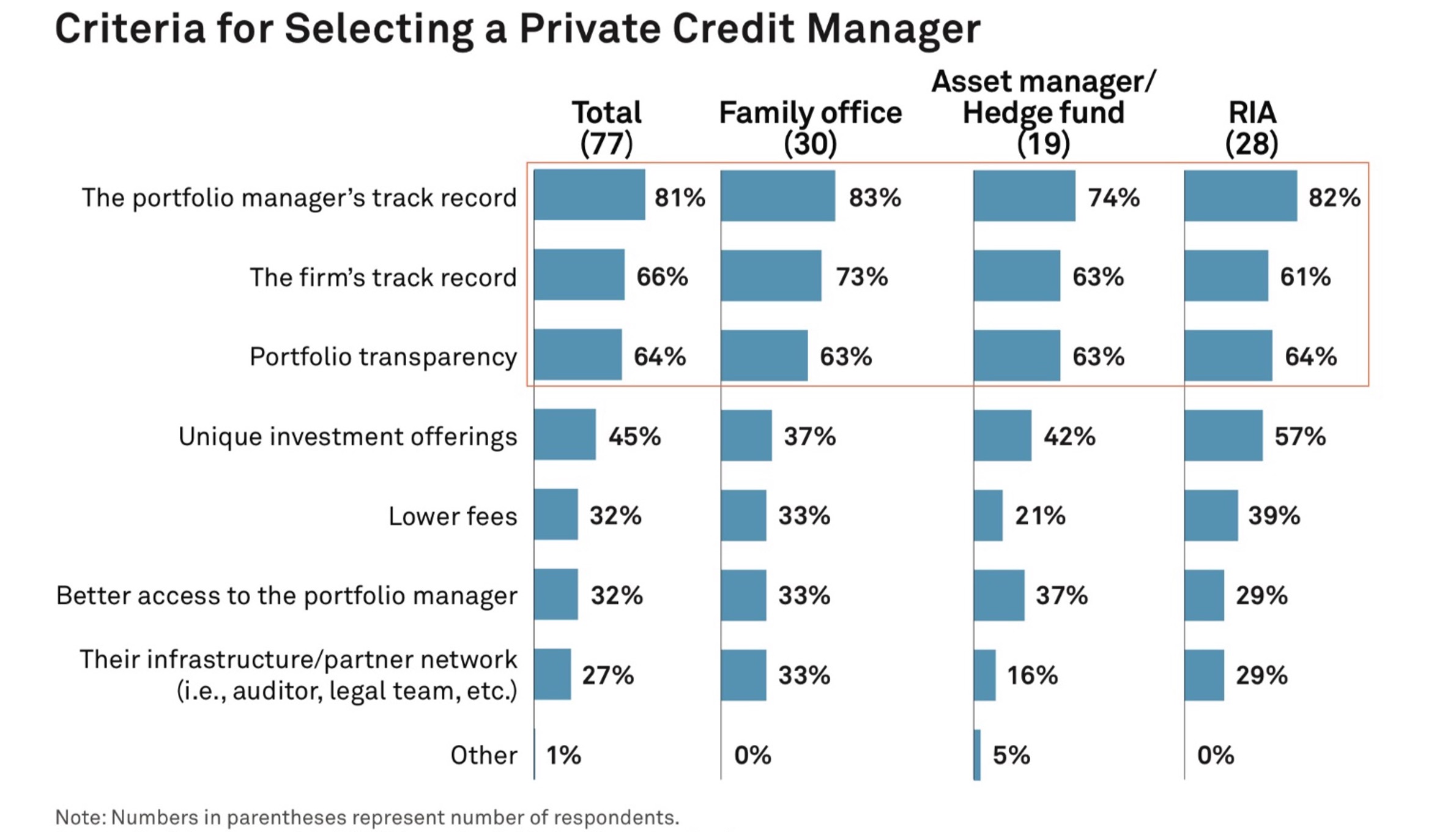

Read MoreChart of the Week: All About Portfolios

Top three criteria investors use to select credit managers are portfolio-centric. Source: Coalition Greenwich 2023 Private Credit Market Structure Study(Past performance is no guarantee of future results.)

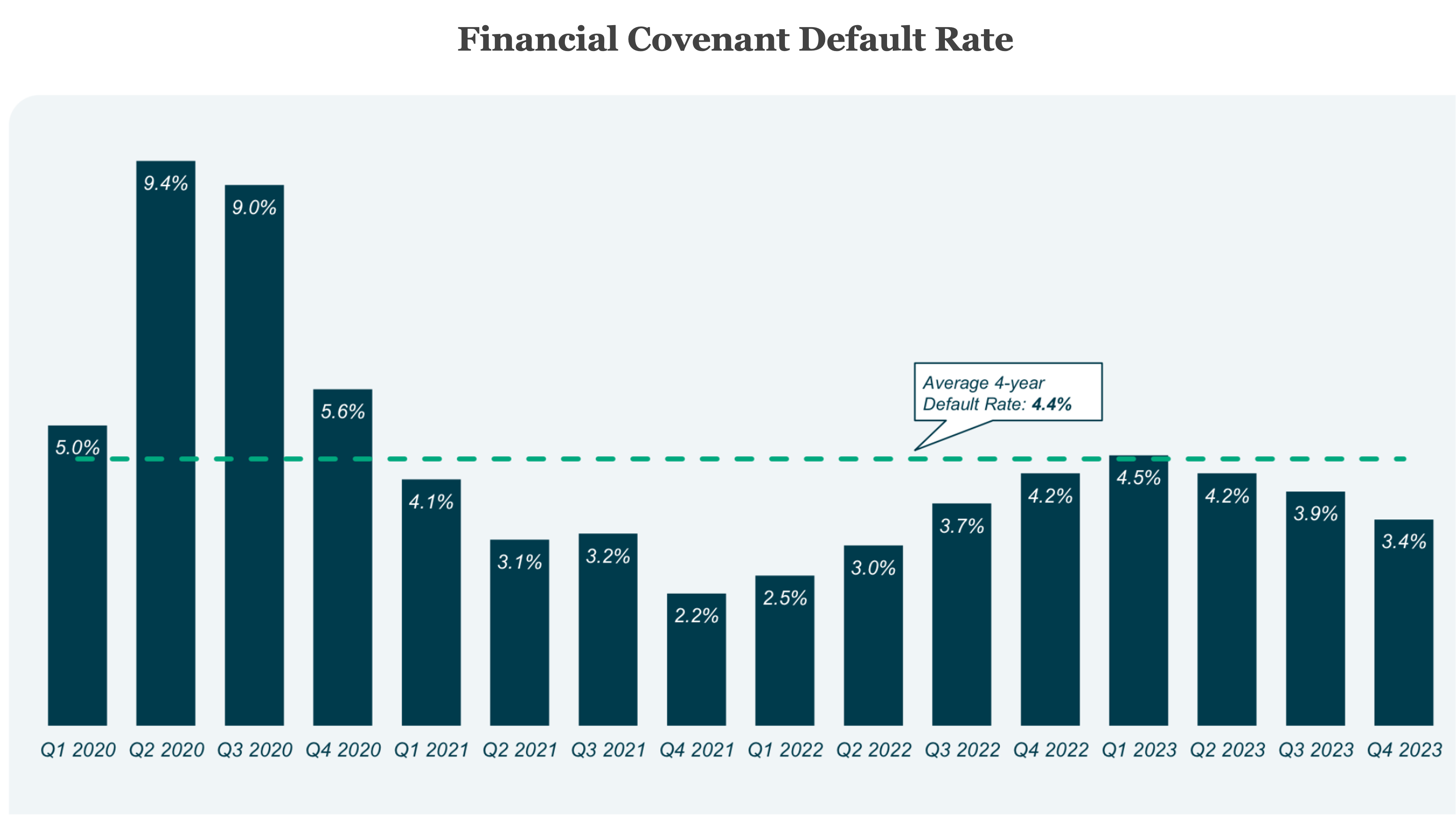

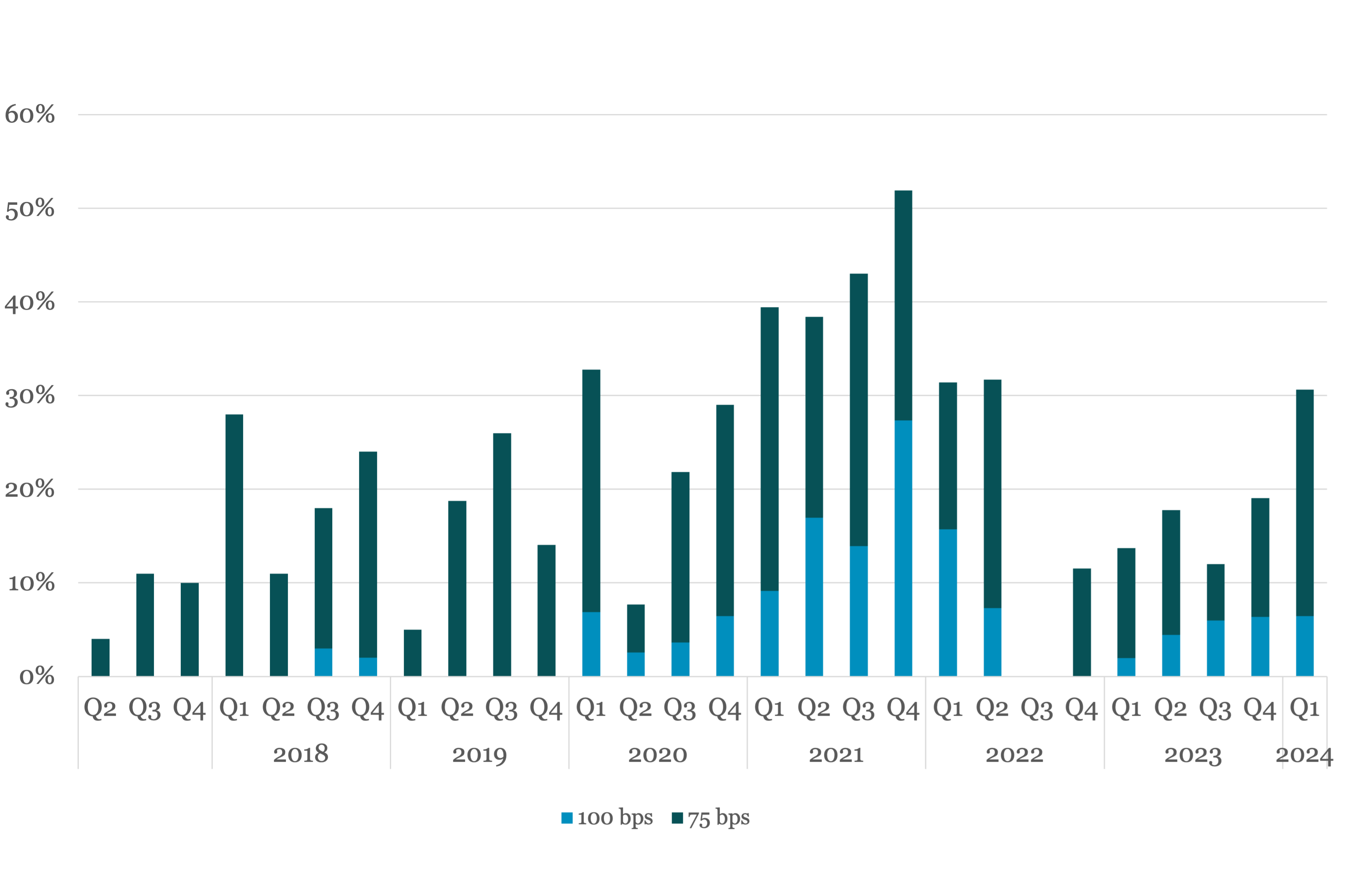

Read MoreChart of the Week: Stepping Down

Private borrower covenant (not payment) default rates fell for third straight quarter. Source: Lincoln International Proprietary Private Market Database(Past performance is no guarantee of future results.)

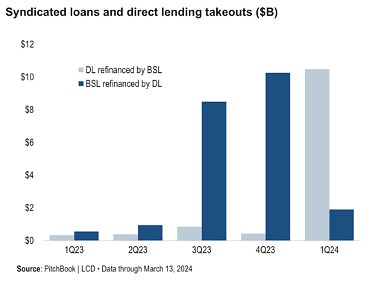

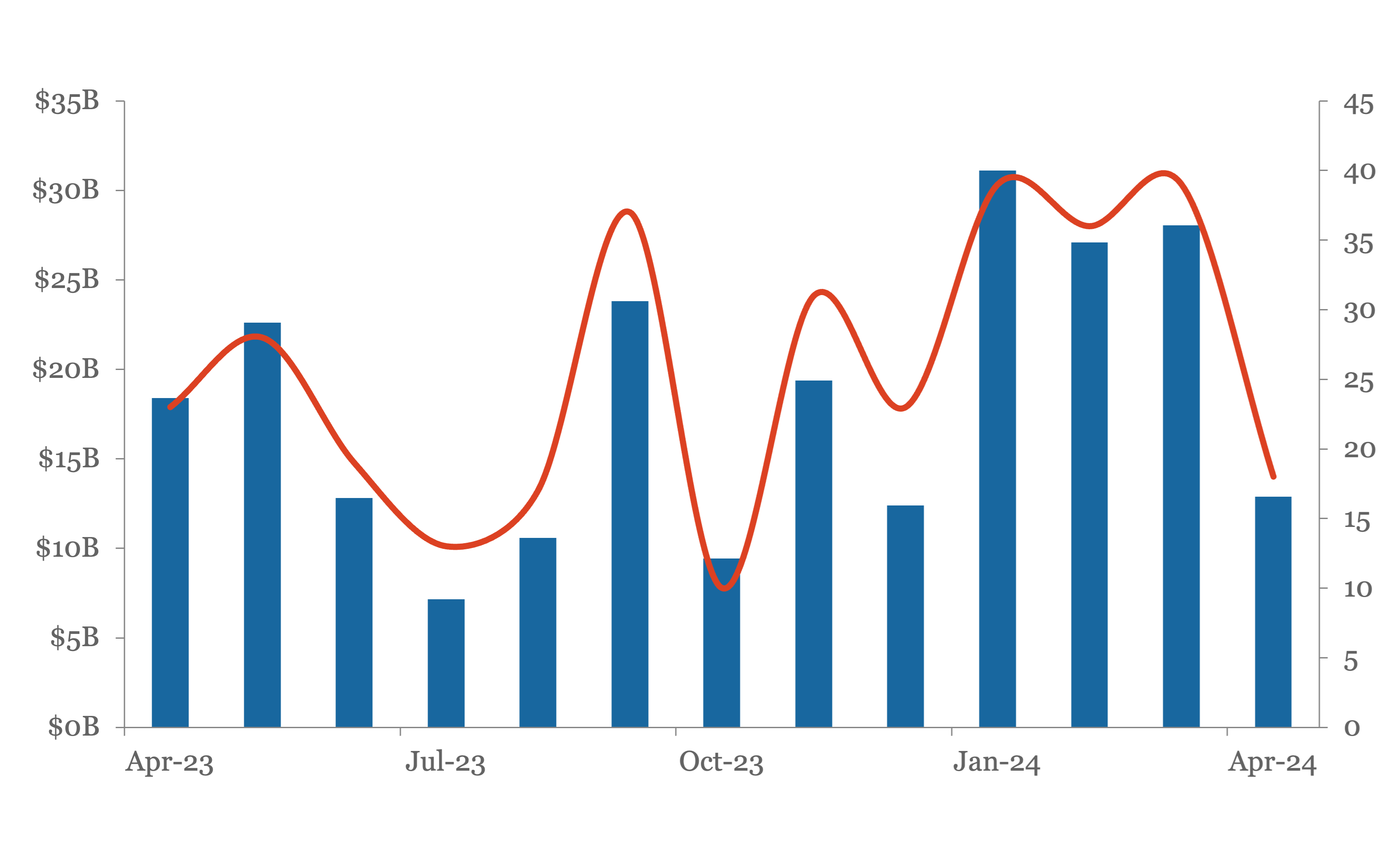

Read MoreChart of the Week: Refi Madness

The reversal of refinancings between direct lenders and the liquid market is dramatic. Source: PitchBook LCD(Past performance is no guarantee of future results.)

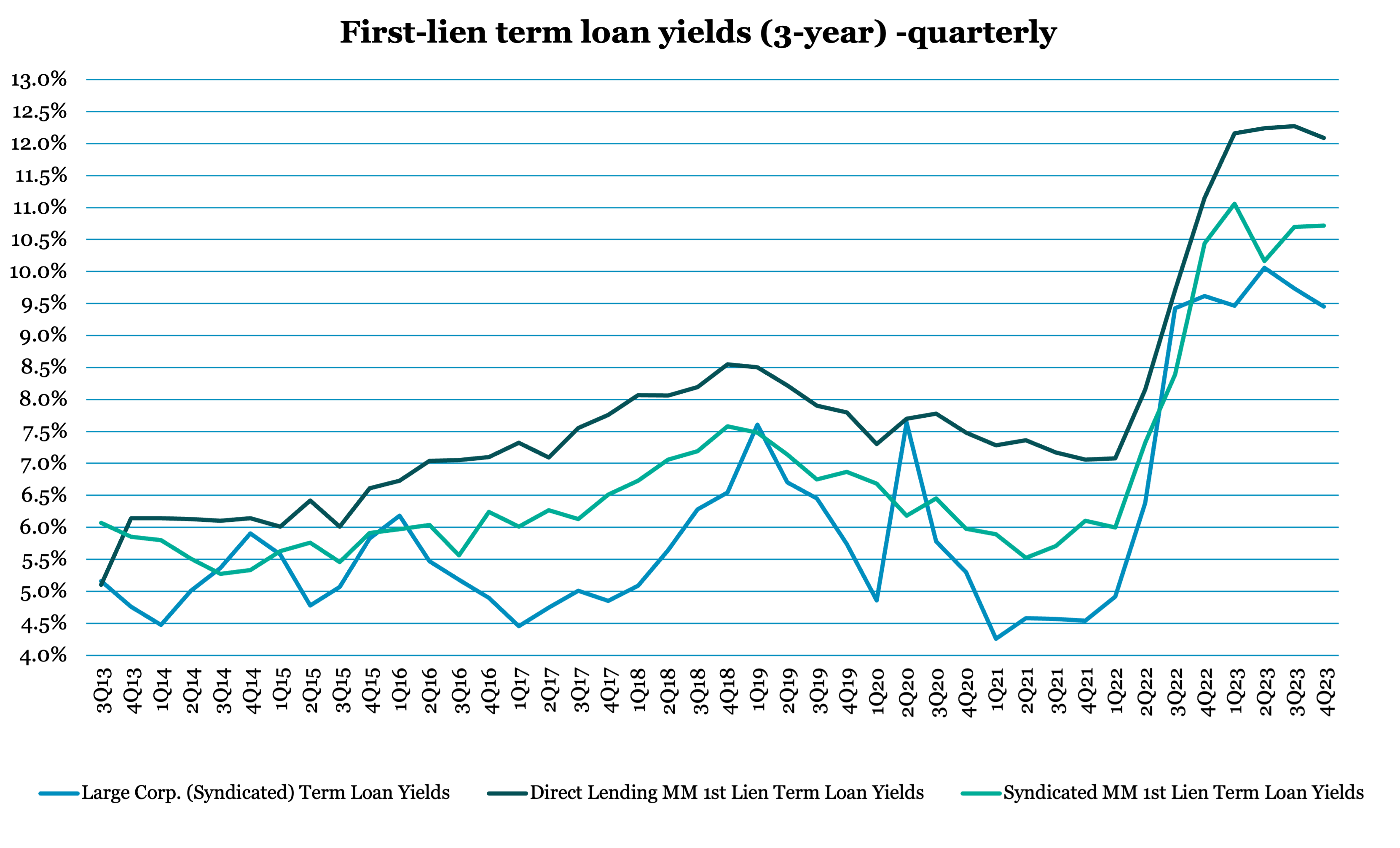

Read MoreChart of the Week: Spready as She Goes

Despite modest spread softening, direct lending yields remain at record levels. Source: LSEG LPC(Past performance is no guarantee of future results.)

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

Leveraged Loan Insight & Analysis – 4/15/2024

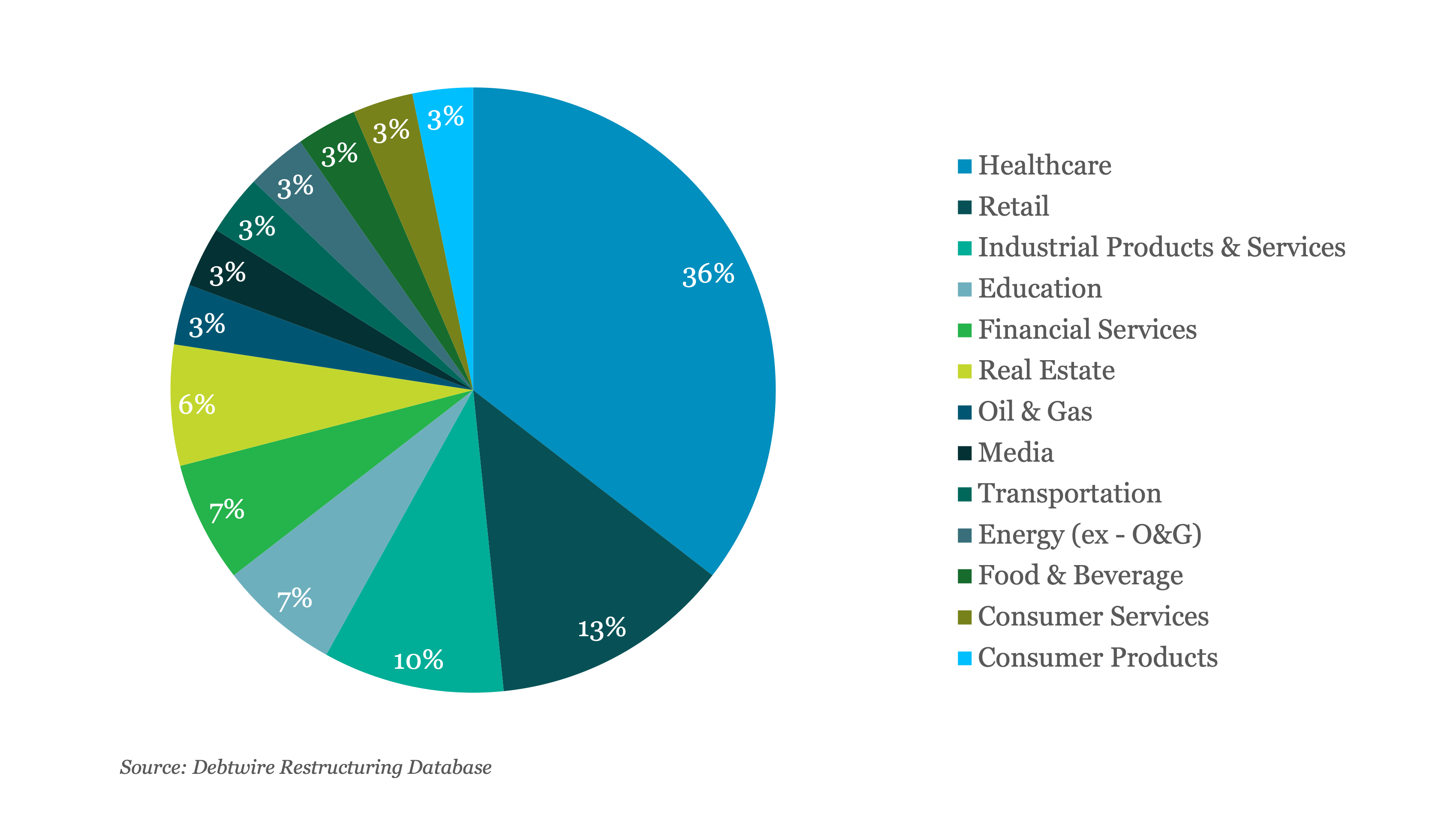

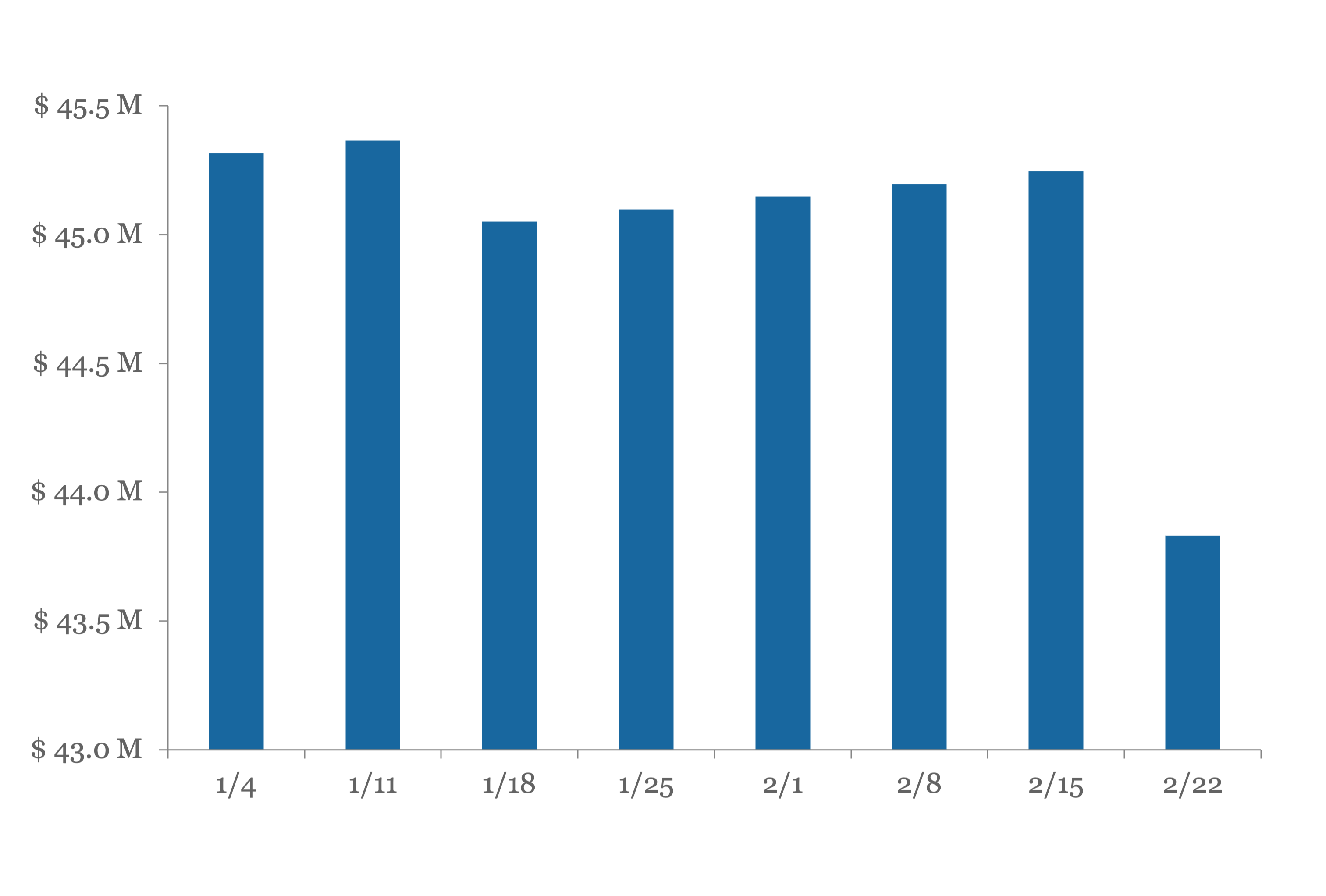

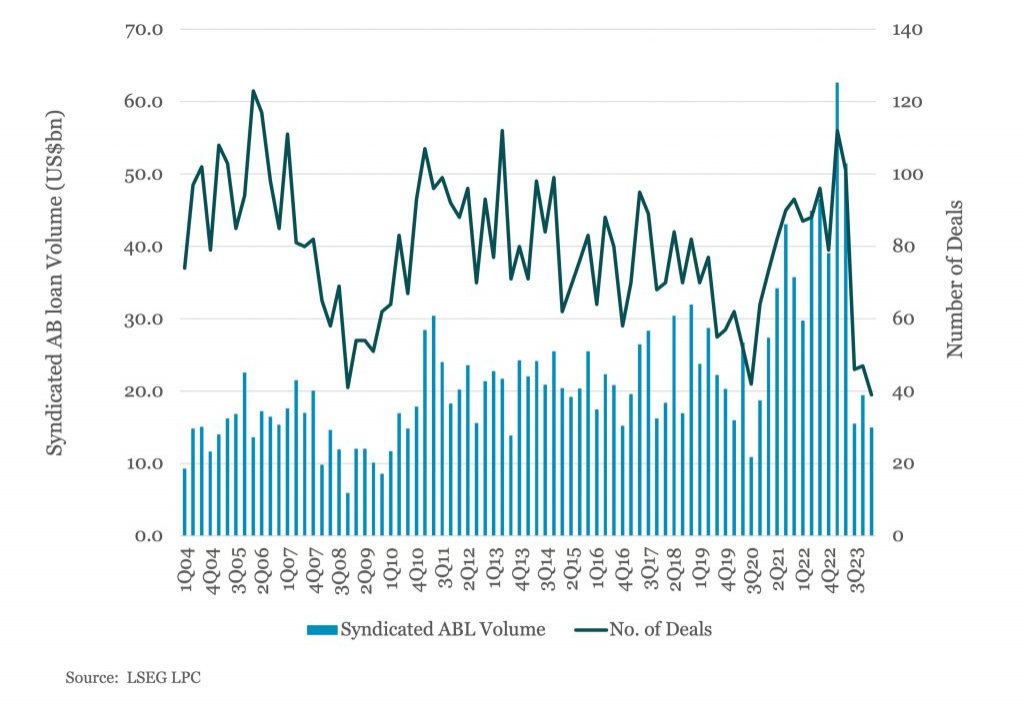

1Q24 ABL loan volume down 76% year over year at US$15bn US lenders completed US$15bn of asset based loan volume in 1Q24, marking the lowest quarterly total since 3Q20 during the height of the Covid pandemic and a 76% drop in issuance year over year…. Login to Read More...

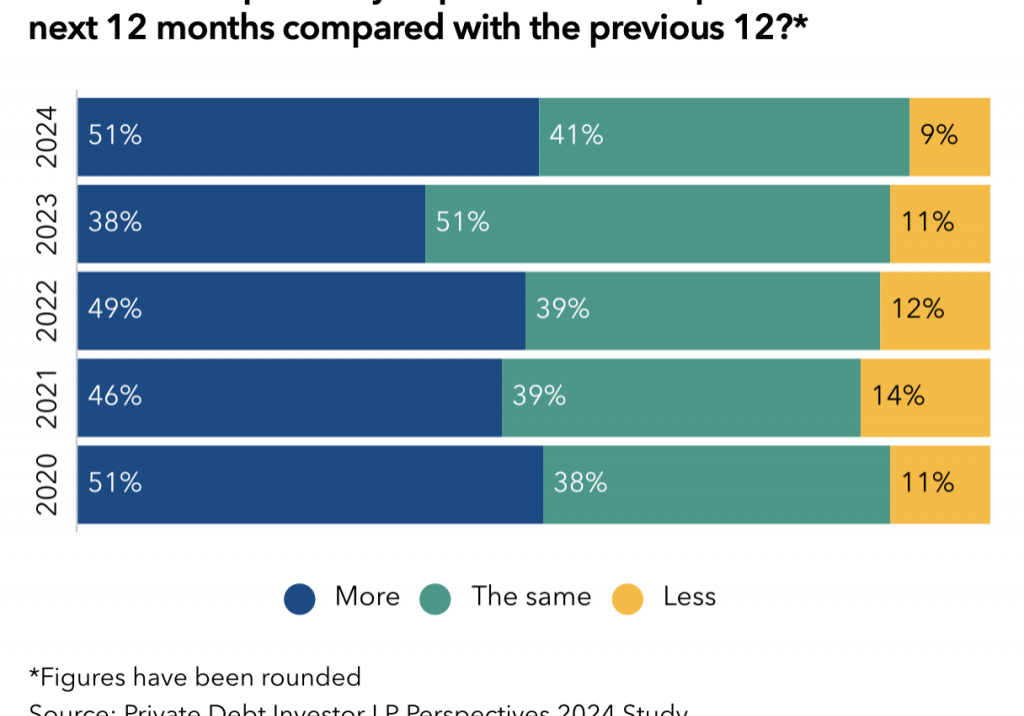

View ArticlePDI Picks – 4/15/2024

The investor view from Asia The need for income and the attractive risk/return profile of senior strategies are among the reasons why private debt is popular among LPs based in APAC. Private Debt Investor’s recent APAC Forum in Singapore featured many views and insights from leading investors in the region. As our chart shows, appetite…

View ArticleMiddle Market & Private Credit – 4/15/2024

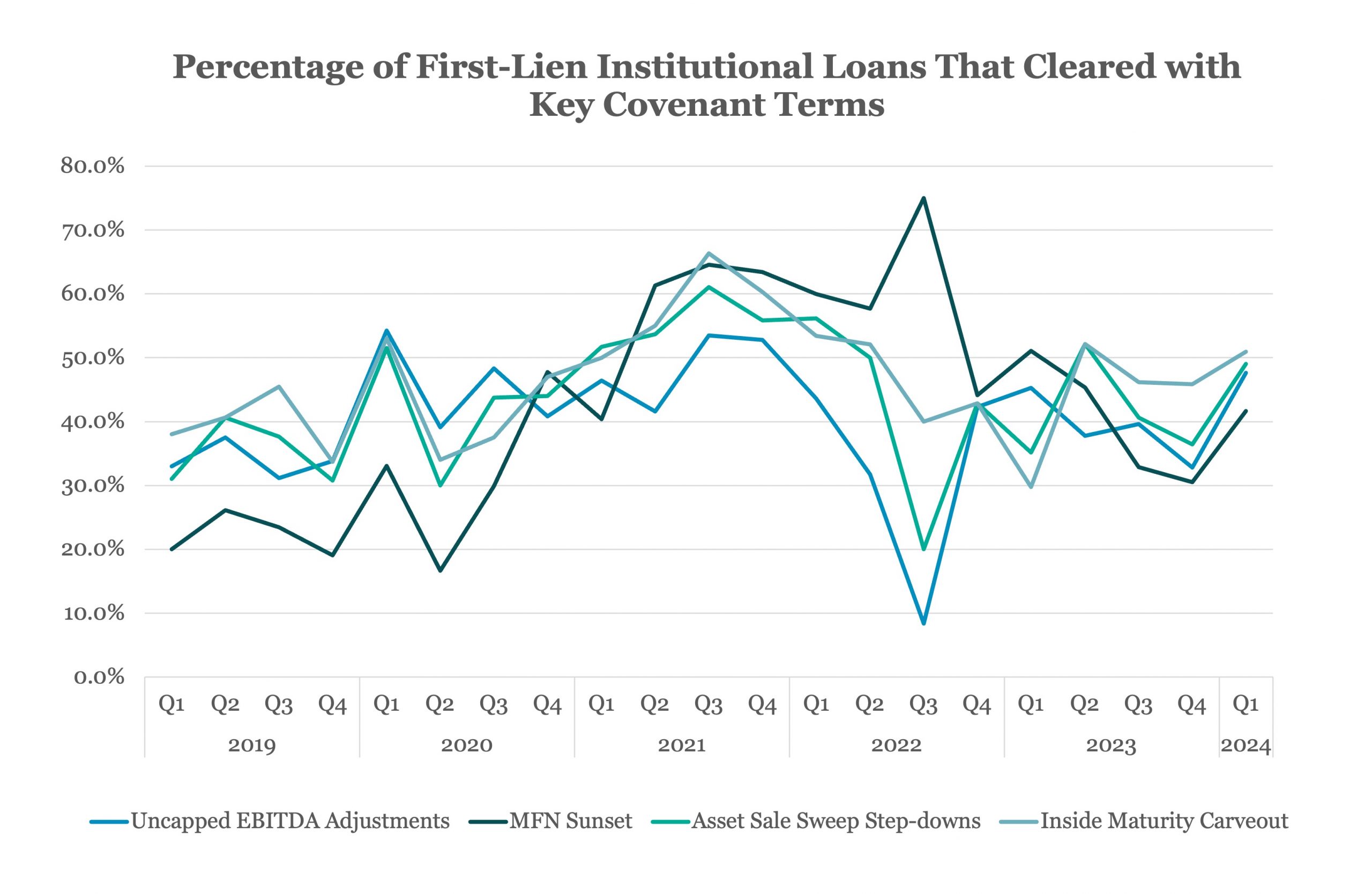

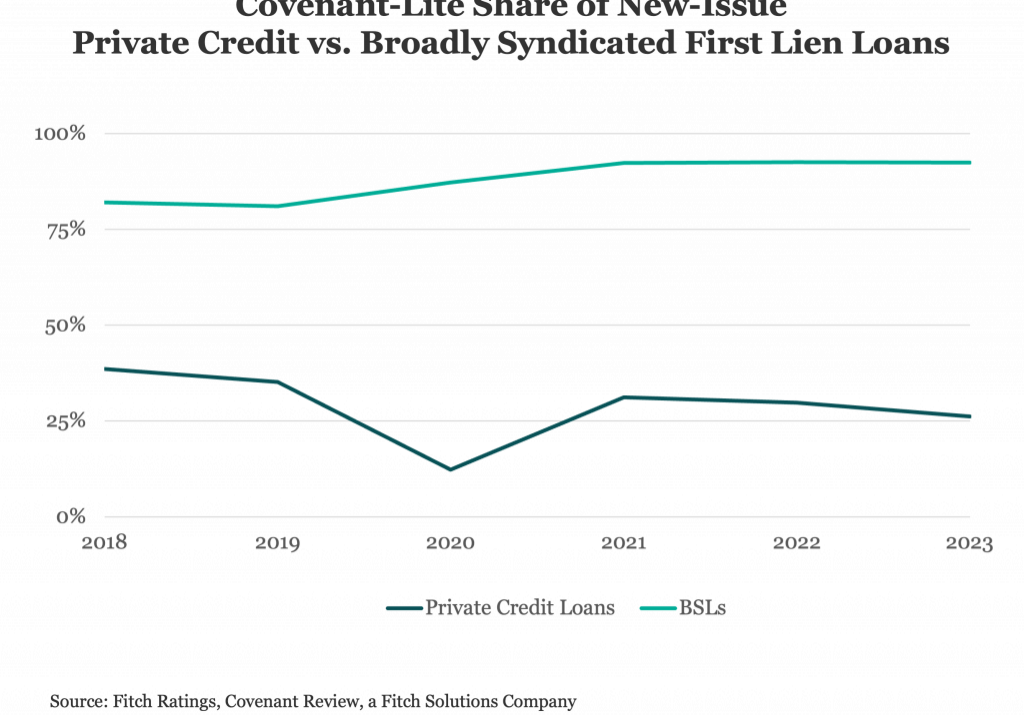

How Do Covenants for Private Credit Loans Compare to Broadly Syndicated Loans? Download FitchRating’s Report here. While liability management exercises (LMEs) are not necessarily prohibited in direct lending documents, they are considerably less common than in the BSL market. We have yet to observe LMEs in the private credit portfolio rated for asset managers…. Login

View ArticlePrivate Debt Intelligence – 4/8/2024

Family offices warm to Infrastructure, private debt, and hedge funds Private equity is the main alternative asset class for family offices, with 58% of those tracked by Preqin active in the strategy, ahead of real estate (46%). However, while just 21% of family offices are active in hedge funds and private debt and 20% in…

View ArticleLeveraged Loan Insight & Analysis – 4/8/2024

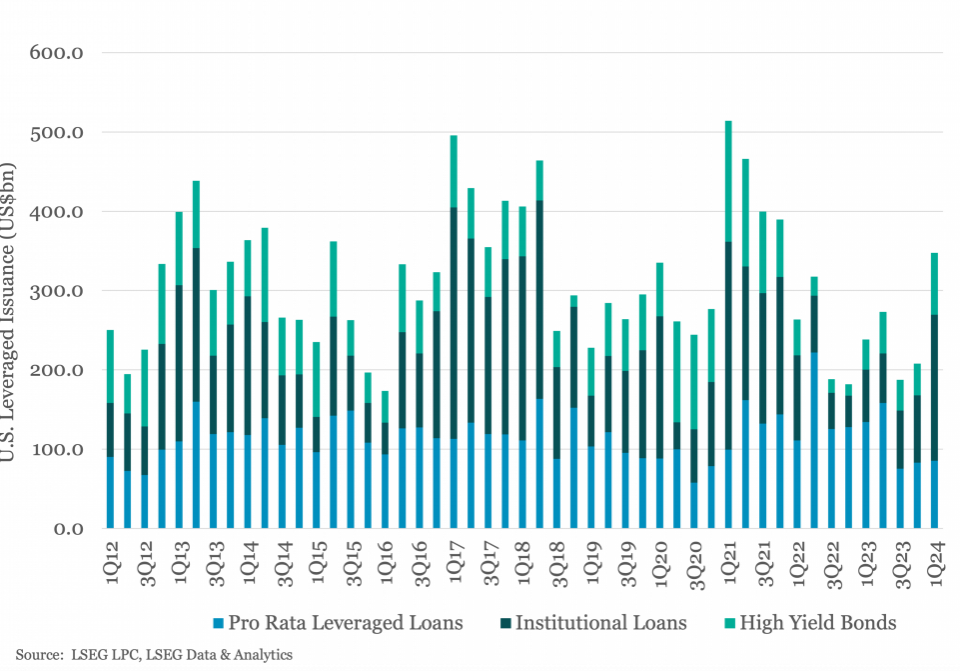

1Q24 US Leveraged volume up 46% year over year; Highest quarterly total in over 2 years US leveraged lenders completed US$347.5bn of issuance across the high yield bond and leveraged loan markets in 1Q24, a 46% increase compared to the same time last year and the strongest quarterly results since 4Q21. More interesting was the…

View ArticleBeginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

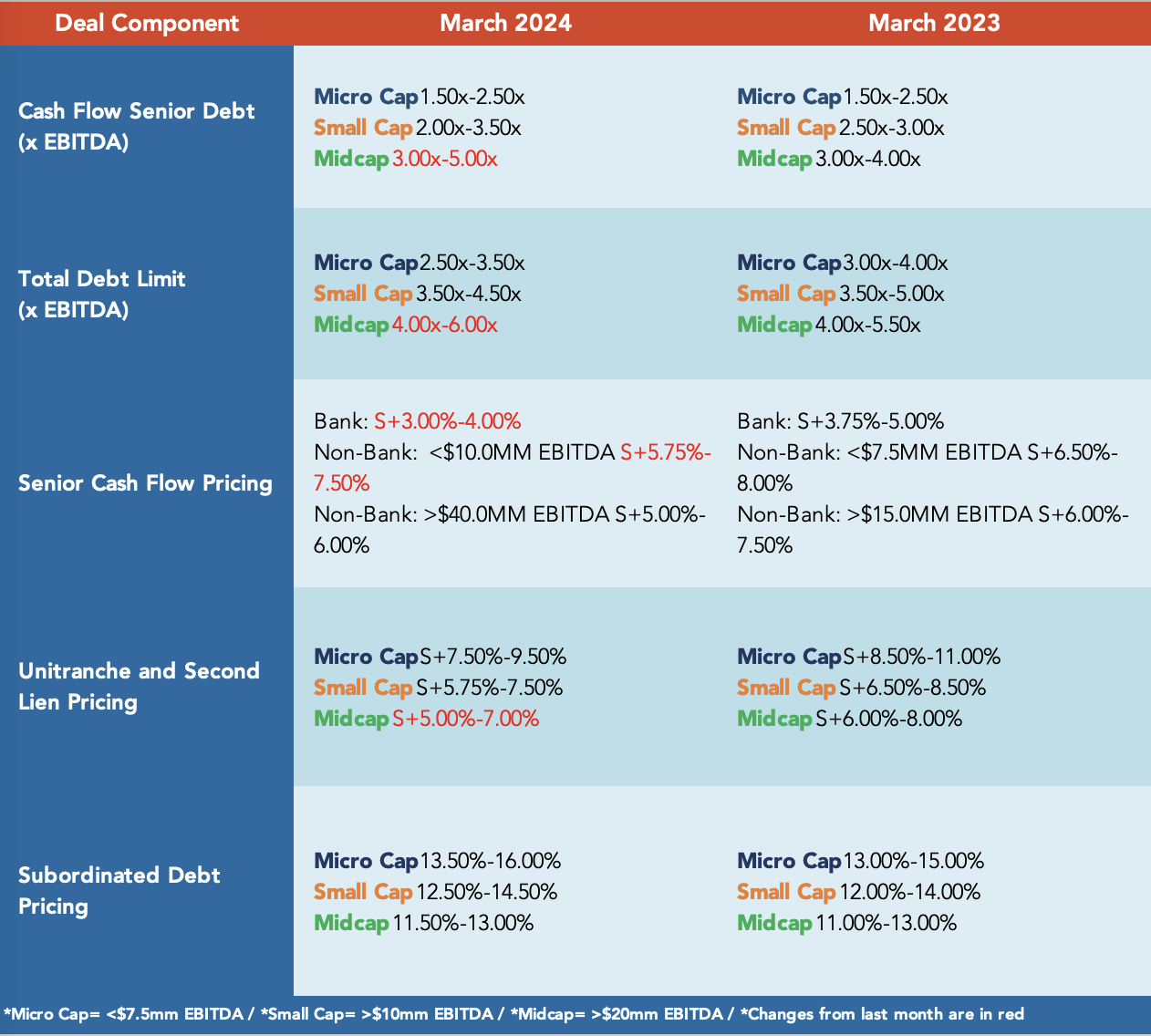

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Login to Read More...

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.