PDI Picks – 2/16/2026

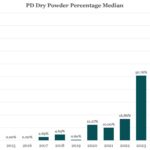

Dry powder presents a deployment challenge Hopes of a significant M&A upturn will need to be realised to address a growing capital supply and demand imbalance in private credit. While other alternative asset classes have had their fundraising struggles, those raising capital for private credit have almost never had it better. Our full-year fundraising figures…