TheLeadLeft

Private Debt Intelligence – 3/1/2021

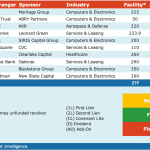

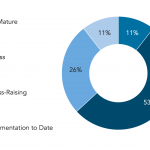

Fund Manager Views on Where They are in the ESG-Implementation Lifecycle Private Debt fund managers are lagging on ESG implementation compared with other asset classes. From a survey conducted by Preqin to fund managers, only 11% of private debt fund managers are at the mature stage of the ESG implementation lifecycle, compared with 27% of…

2021: The Great Reception (Last of a Series)

We wrap our special series with an outlook for private credit. The value proposition of the asset class was fully supported through last year’s extreme volatility as experienced managers and their portfolios emerged mostly unscathed. But as market conditions develop this year, how will private credit terms be impacted? BSL technicals, such as fund flows,…

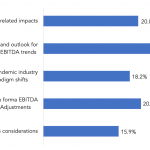

Chart of the Week: Refi Madness

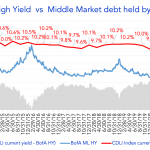

Recently compressed loan spreads leading to more BSL repricings; middle market is lagging.

Debtwire Middle-Market – 3/1/2021

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…

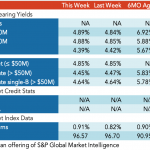

Loan Stats at a Glance – 3/1/2021

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

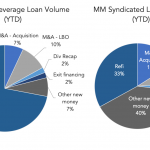

Leveraged Loan Insight & Analysis – 2/22/2021

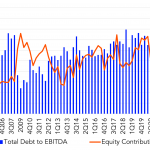

Leverage on US LBO deals stays at all-time highs this quarter Total leverage levels for US LBO loans remain high, averaging over 7.5x so far this quarter. 4Q20’s average of 7.2x was the all-time high tracked and that momentum has continued into 2021…. Login to Read More...

2021: Injections and Projections

What have you missed most over the past few months? Well, if you said “Grape-Nuts” we feel your pain. Our beloved cereal has gone missing from supermarket shelves across the US. First produced in 1897 Grape-Nuts accompanied Sir Admiral Byrd to Antarctica and Sir Edmund Hillary to Mount Everest. But don’t worry. They’ll be back. […]

The Pulse of Private Equity – 2/22/2021

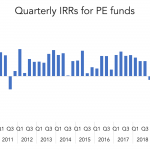

Big bumps in IRR data PE returns bounced back in a big way in mid-2020, according to PitchBook’s upcoming Global Fund Performance Report. After cratering by -8.32% in the first quarter, IRRs were above 9% in both Q2 and Q3. The third quarter mark of 9.81% is preliminary data, but it would be the highest…