Private Debt Intelligence – 7/22/2019

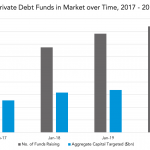

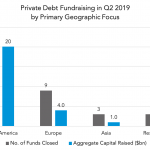

Private Debt Funds in Market in Q2 2019 Through Q2 2019, new private debt funds have continued to come to market, and there are now a record 420 vehicles on the road. Having spiked to $192bn at the start of the quarter, though, the total capital sought in the asset class has fallen back to…