TheLeadLeft

Select Deals in the Market – 6/10/2019

☞ Click for a larger image.

Leveraged Loan Insight & Analysis – 6/10/2019

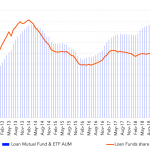

Loan mutual fund AUM continued to decline, ending May at US$137bn Loan retail outflows sent the AUM (market value) for loan mutual funds & ETFs lower to US$137.7bn as of the end of May, a decline of US$1.92bn or -1.4% month on month, and US$9.9bn or -7% since the beginning of the year. Loan funds’…

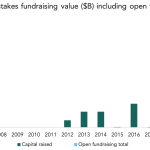

The Pulse of Private Equity – 6/10/2019

GP stakes fundraising starting to boom Download PitchBook’s Report here. An awaited flood of GP stakes fundraising is starting to take shape. The funds currently in the market will eventually amass more capital for the strategy than the past decade combined, according to our recently released analyst note. The majority of those raises will be housed…

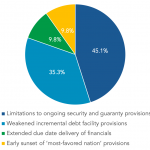

Covenantive Easing (Fourth of a Series)

Our special series on envelope-pushing in the world of loan covenants continues with a look at “limited condition transaction” provisions. These provisions allow the borrower to decide, at its option, when it wants to test the conditions to entering into a transaction (typically an acquisition) that is not subject to a financing condition – sometimes…

Special Report: Why Valuations Matter

Beginning in April 2019 The Lead Left published a series of articles on valuations. This report consolidates those articles.

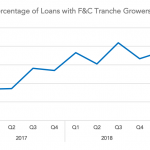

Chart of the Week: Freer and Clearer

The share of loans with free and clear grower components climbed to a record high in the three months through May 2019.

Private Debt Intelligence – 6/10/2019

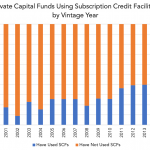

Subscription Credit: Angel or Demon? Private capital funds are using subscription credit facilities – bridge loans made to fund deals in lieu of making capital calls – more than ever. Usage has jumped from 13% in pre-2010 vintages to over 50% of 2015 and 2016 vintage vehicles. But the industry remains divided as to whether…

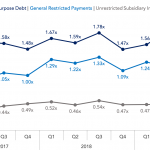

Covenant Trends – 6/10/2019

Average Minimum Day-One Capped Basket Capacity, Quarterly Contact: Steven Miller