Private Debt Intelligence – 3/9/2020

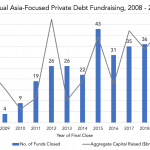

The Rise of Asian Private Debt A growing middle class in Asia has inflated demand for private debt. This swelling middle class has in turn created growth in the SME market, which has led to robust fundraising. Aggregate capital raised for Asia-focused private debt funds has more than doubled from $3.5bn in 2016 to $8.4bn…