Debtwire Middle-Market – 11/1/2021

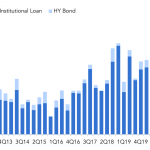

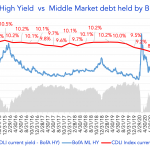

Lower rated borrowers send high yield bond pricing higher in October Source: Debtwire Par High yield bond issuance slowed in October, falling to its lowest level this year at just USD 20.9bn – marking the lowest monthly issuance total for high yield paper since the onset of the coronavirus (COVID-19) pandemic last March. With the…