Debtwire Middle-Market – 3/22/2021

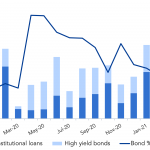

PE firms tap abundant liquidity, yet LBO loan deal flow struggles to meet demand Source: Debtwire Par Financial sponsors have been very busy this year, taking advantage of borrower-friendly market conditions to tap the debt markets at a rapid pace. Sponsor-backed syndicated leveraged loan issuance has already hit a quarterly record of USD 181bn, as…