Debtwire Middle-Market – 7/13/2020

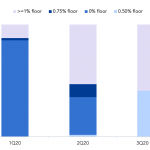

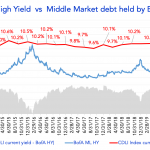

Market shifts to 1% LIBOR floors as key rates remain near zero Source: Debtwire Par With the Federal Reserve cutting interest rates sharply in March, investors have preferred fixed-rate debt instruments in the last several months, as demonstrated by the recent proliferation of high yield bonds. High yield bond issuance soared in 2Q20, with June…