Bloomberg: Leveraged Lending Insights – 2/23/2026

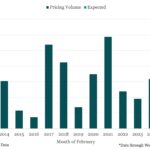

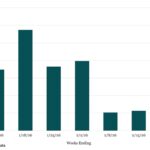

February Loan Issuance Slows Sharply Amid Market Uncertainty Click here to access Bloomberg’s US Leveraged Finance Chartbook Through February 25, just $22.85b of US institutional leveraged loans have priced, with an additional $9.54b expected to allocate before month-end. Even if all scheduled deals price, total issuance will fall well short of January’s $164.1b, marking a…