Private Debt Intelligence – 10/29/2018

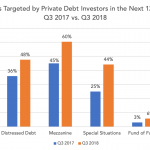

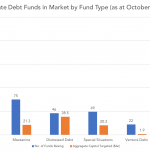

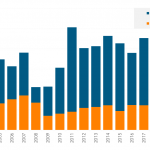

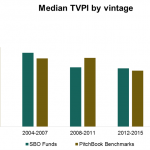

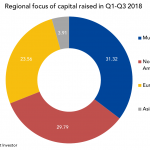

What Are Private Debt Investors Up to? A significant majority (60%) of investor searches issued in Q3 2018 for new private debt fund commitments in the next 12 months were for mezzanine funds, up from 45% of searches in Q3 2017. In fact, there has been an uptick in interest across all strategies, an indication…