Private Debt Intelligence – 7/9/2018

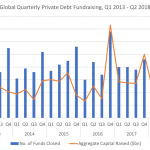

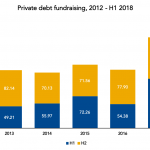

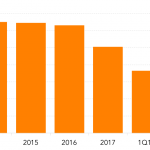

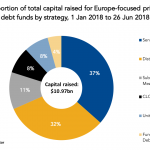

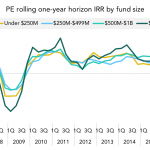

Private Debt: Distressed Debt Dominates Q2 2018 In Q2 2018, 22 private debt funds held a final close, securing a total of $25bn in capital. Although this marks a significant decrease from the 33 private debt vehicles which held a final closure in Q1 2018, Q2 saw an increase of over $5.0bn in capital raised….