Markit Recap – 4/16/2018

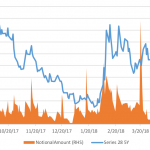

iTraxx Europe – options can influence volumes Fundamental factors rightly garner the most attention when investors try to ascertain why markets move. Even if one regards markets as perfectly efficient and favour index tracking, it would be foolhardy to completely ignore real world influences when managing money. But the credit markets, in particular, warrant analysis…