Leveraged Loan Insight & Analysis – 1/8/2018

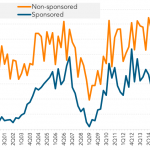

Middle market loan issuance jumps 23% in 2017 to $170B Middle market lending heated up in 2017 and is poised to remain even hotter in 2018. Issuance hit $170 billion in 2017, up 23% from 2016’s weak levels. The sponsored market is driving most of the momentum as LBO issuance of $28bn hit the second…