The Pulse of Private Equity – 5/29/2017

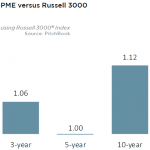

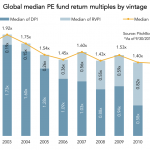

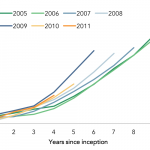

PE’s historical performance still allures in a market plagued by uncertainty View PitchBook’s 2017 Global PE & VC Fund Benchmarking Report: Part II Here Comparing the returns of different strategies is difficult enough, given the typical disparities in approach. Assessing private equity’s performance relative to that of public markets is even more challenging,… Login to