PDI Picks – 5/21/2018

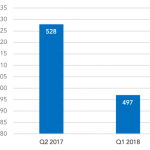

Fewer managers collecting more of the capital Private credit vehicles seeking capital fell from the record level reached in the first half of 2017. The number of private debt funds raising money has fallen slightly from a record number at the middle of last year but it remains strong; as of 31 March, there were…