Leveraged Loan Insight & Analysis – 2/26/2018

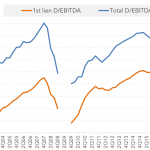

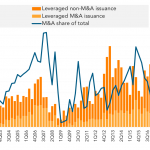

LBO leverage levels continue to loosen Debt to EBITDA levels on LBO deals spanning the entire market (including broadly syndicated and institutional middle market loans) are currently averaging 6.3 times when looking on a rolling last four quarter basis. This would make it the highest post-crisis average and second only to 4Q07’s average of 6.5…