Leveraged Loan Insight & Analysis – 2/5/2018

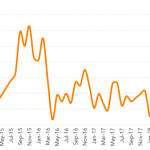

BDC share prices were engulfed by market wrath earlier this week Register now for LPC’s 6th Annual Middle Market Loans Conference – April 25, 2018 at the NY Marriott Marquis! For those investors that are bullish on BDCs, this week was a prime buying opportunity as the middle market debt managers were engulfed in equity…