Leveraged Loan Insight & Analysis – 1/15/2018

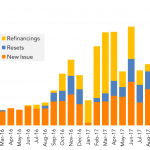

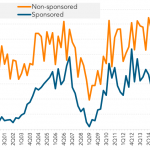

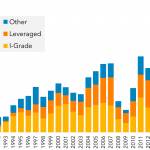

U.S. new issue CLOs reached US$117bn in 2017 with an additional US$165bn in CLO refis and resets Although loan fund outflows have been more frequent since the fall, US$12.7bn flowed into mutual funds in 2017. Separate managed account money grew as pensions, endowments and family offices along with insurance companies, and sovereign wealth funds allocated…