Leveraged Loan Insight & Analysis – 6/20/2016

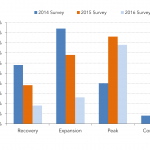

Survey: Where are we in the credit cycle? Thirty-nine percent of buyside and sellside institutions in the room at Fitch Ratings and Thomson Reuters LPC’s Loan & CLO Conference last Thursday felt that we are already headed into a correction and in the late stages of the credit cycle, up from just 4% in both…