Leveraged Loan Insight & Analysis -10/24/2016

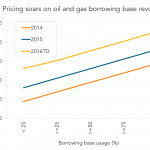

Pricing soars on oil and gas borrowing base revolvers

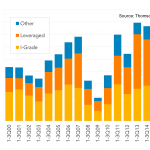

After collapsing to a 10-year low of less than $30 in January, oil prices are now in the $50 per barrel range. While prices might have stabilized, the industry continues to suffer severe consequences. Defaults have escalated and recovery rates are down significantly from their historical levels. According to Moody's, loans that are backed by reserves for exploration and production companies have fared better than other debt types...