Private Debt Intelligence – 10/10/2016

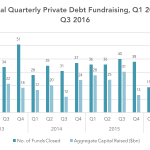

Private Debt Fundraising Remains Low in Q3 2016 Preqin’s Q3 update on the private debt fundraising market finds that the quarter marked a further slowdown in the levels of capital secured by managers in the space, as 2016 continues to see a far reduced rate in fundraising activity from recent years…. Subscribe to Read MoreAlready