The Pulse of Private Equity – 2/28/2022

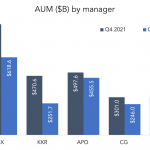

Public PEGs got much bigger last year Download PitchBook’s Report here. 2021 was bumper year for public PE firms. PitchBook’s latest Analysis of Public US PE Firm Earnings has several interesting breakdowns, but YoY AUM trends stand out. Blackstone, KKR, Apollo, Carlyle and Ares all increased their AUMs, some more than others. KKR led the way,…