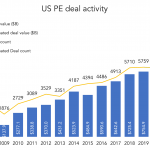

The Pulse of Private Equity – 1/24/2022

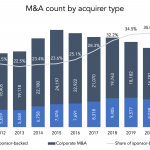

PE a growing presence in M&A Download PitchBook’s Report here. PE deal flow accounted for 38% of global M&A transactions in 2021, a new high. That’s according to PitchBook’s Annual Global M&A Report, released this morning, which also showed a record year for M&A overall. Globally, 38,231 transactions were finalized last year, a 48% leap over…