Private Debt Intelligence – 1/10/2022

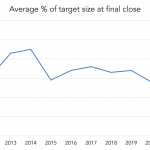

Direct lending most popular PD strategy of 2021 Private debt funds reached an average 120% of their target size at final close last year, with a total of $195.1bn raised. Of this, 58% was raised for direct lending strategies, amounting to $112.5bn over 94 funds. The next largest strategy within the asset class was distressed…