The Pulse of Private Equity – 12/7/2020

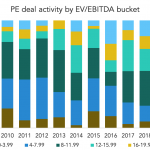

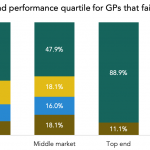

2021 prediction: 20% of buyouts over 20x A bold prediction coming from our upcoming PE Outlook note: 20% of buyouts will be priced above 20x EBITDA. Our numbers suggest around 18% of them are trading above the 20x mark through late November, though there are caveats galore when looking at 2020 activity. Many of the…