The Pulse of Private Equity – 1/27/2020

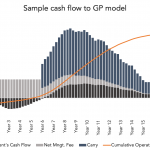

What is a private capital fund worth? Download PitchBook’s Report here. Valuing PE management companies can be extremely difficult, but the rise of GP stakes investing is making the task more common. In recent years, many GPs have been valued predominantly on cash flows, management fees and accrued performance fees…. Login to Read More...