The Pulse of Private Equity – 11/4/2019

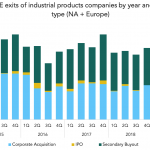

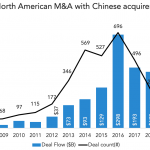

Manufacturing exits are way down We covered China-driven M&A last week, noting that activity has taken a nosedive this year. Chinese acquirers aren’t buying many American companies at the moment, thanks in part to the broader trade war. According to a newly released report from PitchBook and RSM, however, PE is having a rough time…