The Pulse of Private Equity – 8/12/2019

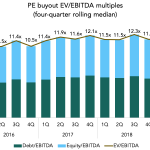

Tea leaves for multiples News this week about the yield inversion will probably have an effect on investor psyche. Inversions have historically predated recessions by as many as 24 months—that particular lag (2005-07) also included a significant rise in the S&P. In four of the last five years, the lag between inversion and the start…