The Pulse of Private Equity – 10/22/2018

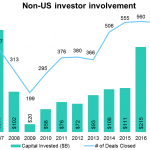

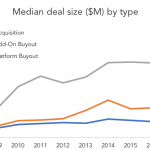

Barreling toward a record Download PitchBook’s Report here. US middle market PE activity is set to break records this year. Through Q3, more than 2,000 transactions have closed totaling $289 billion in investments. At that pace, 2018 is looking at more than 2,700 deals at more than $385 billion invested…. Login to Read More...