The Pulse of Private Equity – 11/30/2015

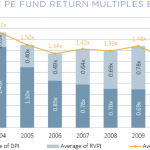

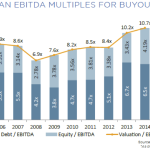

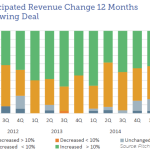

Could PE Return Multiples Begin to Stagnate? Driven by the seller’s market over the past few years, recent private equity fund vintages have seen their return multiples improve considerably. Distributions back to limited partners have risen to staggering levels, with 2014 seeing no less than $467.8 billion alone…. Login to Read More...