The Pulse of Private Equity – 6/29/2015

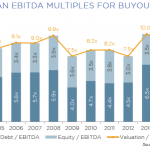

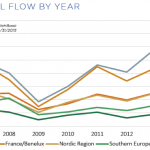

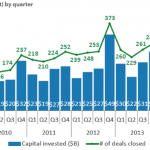

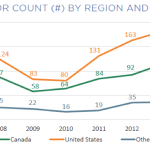

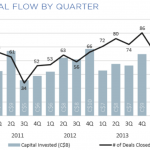

Multiples are having an impact, and that’s a good thing Global private equity activity was down in H1, by several metrics. Compared to H1 2014, deal flow declined 16% by count and 21% by total value, to 2,728 deals worth $404.7 billion. Last year’s numbers were 3,265 deals worth a combined $514.7 billion…. Login to Read