Private Debt Intelligence – 2/28/2022

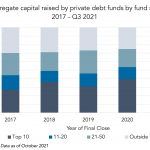

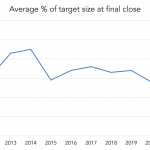

Private debt sees continued consolidation among fund managers As private debt continues to grow, so does the size of its largest funds. In Q1 to Q3 of 2021, the top 10 managers in the asset class by AUM accounted for 42% of all capital targeted, while their smaller peers outside of the top 50 attracted…