Private Debt Intelligence – 12/13/2021

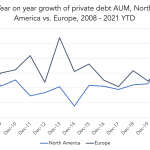

US Remains Most Attractive for Private Debt, But Other Markets Are Catching Up Every year, Preqin asks investors which developed markets they think are presenting the best opportunities in private debt. The US is the top market, although the 65% of investors who identified it is down from 77%. However, a number of other regions…