Private Debt Intelligence – 10/4/2021

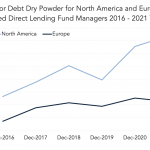

Dry Powder for Direct Lending Senior Debt at Record High Almost 60% of dry powder in direct lending is allocated to senior debt, with $103.9bn available for investment worldwide as of October 2021. The majority of this, $73.8bn, is with North America-based fund managers, with European fund managers coming in second with $22.5bn…. Login to