Private Debt Intelligence – 4/26/2021

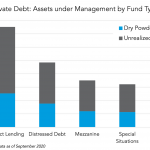

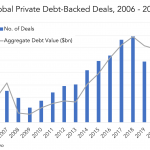

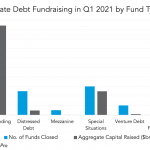

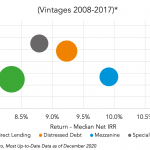

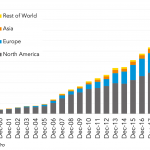

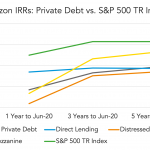

Record levels of dry powder pressure PD returns A rise in inflation and ongoing asset purchases from central banks will make it harder for private debt funds to deploy dry powder in the future, raising the prospects of increased competition and lower returns…. Login to Read More...