Private Debt Intelligence – 4/6/2020

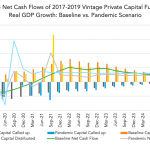

The impact of COVID-19 on capital calls, distributions, and net cash flows A Preqin-FRG forecasting model shows that capital calls will surge in 2021 as the global economy rebounds. Focused on 2017-2019 vintage private capital funds, the model suggests that, as a result of COVID-19, and assuming the global economy undergoes a significant but brief…