Private Debt Intelligence – 1/27/2020

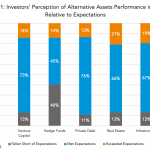

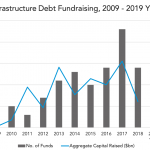

Private Debt Investing for the Long Haul Investors in private debt are generally satisfied with the performance of their portfolios. Eighty-nine percent of those we surveyed by Preqin in November 2019 said private debt performance had either met or exceeded their expectations over 2019… Login to Read More...