Private Debt Intelligence – 11/4/2019

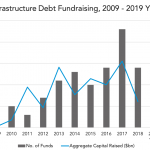

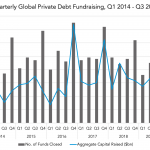

Infrastructure Debt Reaches Momentum Debt providers in more specific sectors have started to take the place of traditional lenders, as for example in the infrastructure industry. Banks are no longer the main source, and investors are moving towards funds to gain access to the capital structure. Infrastructure debt fundraising has had peaks and troughs over…