Private Debt Intelligence – 9/24/2018

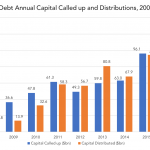

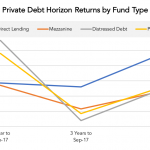

Private Debt Capital Distributions Reach Record Highs Private debt has a history of strong returns, and the asset class has consistently met, and often exceeded, investors’ performance expectations. In fact, according to Preqin’s latest survey of institutional investors, 91% of investors said that private debt has met their performance expectations over the past 12 months,…