Private Debt Intelligence – 4/30/2018

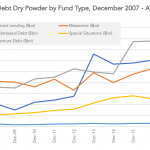

Direct Lending Drives Dry Powder Growth The private debt industry has seen relatively small increases in dry powder (capital waiting to be deployed) in recent years. After spiking by 23% across 2015, annual rises in 2016 and 2017 were just 3% and 7% respectively, with a further 3% rise to the end of April 2018….