Private Debt Intelligence – 1/17/2023

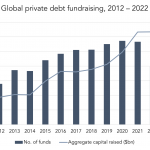

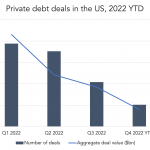

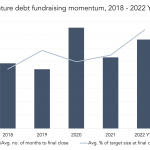

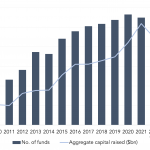

Private debt funds grow larger in slower market Private debt fundraising slowed down in 2022. The number of funds that raised capital fell 30% from 283 in 2021 to 199 in 2022. However, the average size of private debt funds has grown to a record $1.3bn…. Login to Read More...