Private Debt Intelligence – 7/25/2022

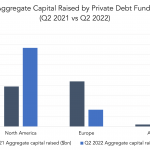

Rapid growth in fundraising of Asian private debt funds There has been a rapid uptake in fundraising by private debt funds in Asia over the past year. The aggregate capital raised by private debt funds in Asia was $6.3bn in Q2 of 2022, growing over 6x from the $1bn raised in the same quarter last…