PDI Picks – 1/12/2026

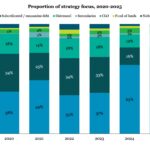

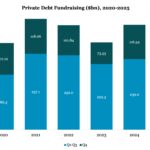

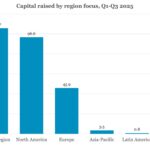

Senior debt fundraising falls from its peak Our data for private credit capital raising by strategy shows investors once again diversifying their commitments rather than concentrating them. At first glance, it appears that last year saw investors significantly re-align their strategic priorities when it comes to private credit. But a closer examination of the PDI…