PDI Picks – 2/28/2022

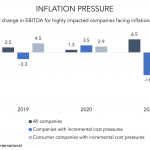

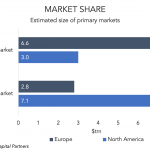

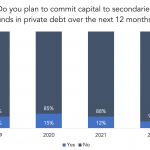

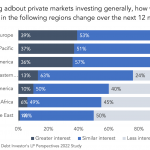

Europe has maintained its deal discipline Despite some inflation effects being felt, the overall picture is rosy for those operating in the market. A new report from investment banking advisory firm Lincoln International highlights some of the trends from a strong year for deals in Europe in 2021. One area for concern in previous Lincoln…