PDI Picks – 6/3/2019

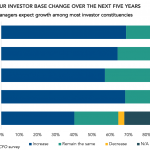

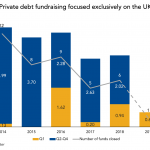

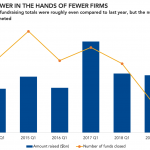

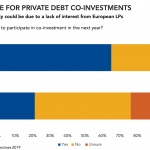

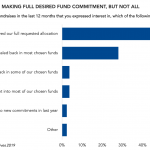

Firms bullish on an expanding investor base As alternative assets continue their rise, private fund managers may well keep notching additional LPs with each new product and successor fund. A majority of private fund managers expect to see growth across most aspects of their investor base, according to a survey conducted last month by Private…