PDI Picks – 2/13/2023

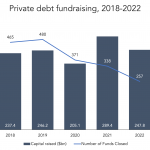

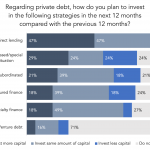

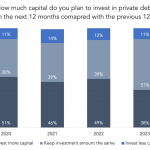

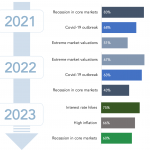

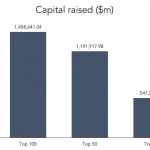

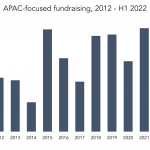

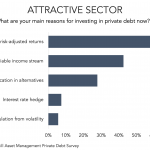

Fundraising holds up well The volume of capital gathered remained at healthy levels last year, although the number of funds closed sank to new lows. It wasn’t a record-breaking fundraising year for private debt in 2022 but, with concerns about the economy growing, there were few signs of limited partners changing their positive view of…