Leveraged Loan Insight & Analysis – 9/7/2020

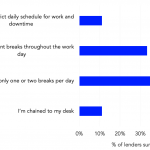

Covenant and pricing changes were two most amended provision in 2Q20 US middle market Refinitiv LPC tracked 50 US middle market publicly filed 8K summaries that involved a loan amendment in 2Q20. The most changed provision according to those summaries was to financial covenants, where 48% of the amendments involved a change. Borrowers either received…