Leveraged Loan Insight & Analysis – 10/28/2019

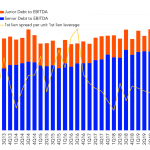

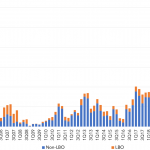

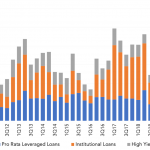

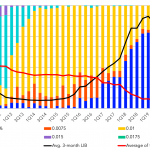

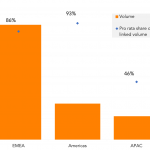

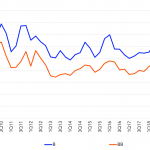

Total leverage on large corporate US LBO loans remains high in 4Q19, but senior leverage declines At a time when investors have been pushing back on pricing and structure on riskier loans, total leverage on US LBO deals remains high. So far this quarter the average total debt to EBITDA level for large corporate LBO…